Conditions and solutions for the removal of fuel subsidy in Angola

Summary of the proposed policy

In this document there are necessary conditions and possible solutions for the removal of the subsidy to fuel in Angola.

1-The necessary conditions are:

a) Creation of transparency mechanism of budgetary financial flows. The fate of savings made with the withdrawal of subsidies, emphasizing social aspects;

b) Modification of the oligopolistic market structure. Promotion of competition in the fuel distribution market. One hypothesis is the split of Sonangol distribuição in three entities and privatization of two of them.

2-The possible solutions are:

a) Focus on the subject

AA) direct subsidy to the most disadvantaged and social pass

AB) direct allowance to companies

AC) Tax Benefit /Negative Tax to AA) and AB)

b) Focus on the object

BA) Subsidized fuel prices continues for lower displacement vehicles

BB) subsidized fuel prices continue for transportation companies and similar

c) Composite systems

***

Elimination Fuel Subsidies: IMF and Vera Daves

It is an integral part of any intervention of the International Monetary Fund (IMF) to have fuel subsidies withdrawn, where they exist. Of course, the same booklet was followed in Angola creating this burden on the Angolan government.

In terms of fiscal policy, in the recent Staff Report according to article IV the fund makes this the main measure to take at the level of fiscal policy, prescribing that: “Authorities need to take political action to increase non-oil tax revenues and gradually eliminate fuel subsidies while increasing support for vulnerable. These measures should help reduce vulnerabilities debt, create tax space and achieve their fiscal and medium-term debt goals. ”[1] (emphasis added).

Minister Vera Daves tunes for the same tuning fork, and in a recent interview said that the removal of fuel subsidies is “the elephant in the middle of the room, and with ballerina shoes”, stating that the political decision was made and was not implemented only because it is lacking to find the mechanism that reduces the impact on the most disadvantaged. And she explained that: “It is a blind subsidy, which everyone accesses, and with this revenue we could have a more directed policy instead of subsidizing those who do not need.” Adding arguments for the elimination of this measure as “fuel leakage to neighboring countries, lack of market share and the consequent loss of tax revenue, beyond the issue of inequality of treatment. There are several distortions to the market, but we are aware that the impact, especially through transport, is considerable. “It also recognized the negative impact on municipalities, industries and farms and the price of freight to transport food. And concluded by saying:” We have everything mapped, now the challenge is to take the dancer’s shoe thinking of measures that can mitigate the removal “from this allowance that costs between $ 3 and 4 billion, about $ 2.8 to 3.7 billion euros, per year. “It is a considerable value, given that the Integration and Intervention Program in the municipalities (PIIM) has 2 billion, so it would be two PIIM. ”[2]

It seems, therefore, that the IMF and Vera Daves are determined to eliminate fuel subsidies, apparently they do not know yet is how.

The political issue and the mechanism of transparency

It is evident that these eliminations, even making sense economically, and we will already address doubts in this context, have a large political impact and cannot be viewed as a “lightweight”. From Egypt to Iran to Sudan, France, changes in fuel prices have impacts on political stability, so the first assessment to do is political.

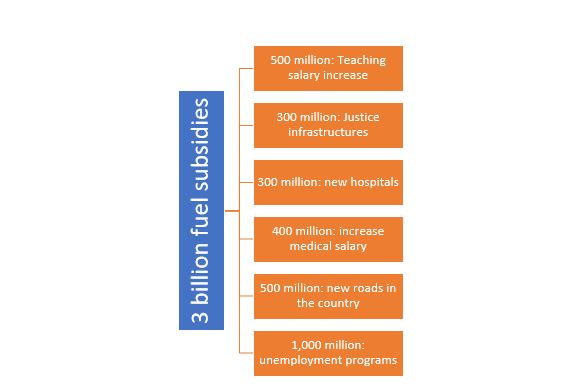

The great argument advanced by Vera Daves is the one that technically is called Crowding Out. By spending 2.8 to 3.7 billion euros, a year on fuel subsidies, the government does not spend them in the social sector, in education and health, for example. In fact, she argues, what is put in the lowering of the price of gasoline is taken from the well-being of the people. Accepting the argument, it must be sustained and convince the population. Accordingly, the first task would be to create a transparency mechanism (perhaps in the form of a digital site) that explained to the population how the background of subsidies would be channeled to other sectors, clarifying government plans. 1000 million for schools, 500 million for teachers, etc. Making a simple scheme and spreading it, everyone would realize the fate of money, and then over the early years there should be a public presentation of this flow. It would be explained by a scheme where the savings had gone with the removal of fuel subsidies. Consequently, the population would see that it had not been invented by the Minister of Finance, but that it was effectively happening.

A first preparatory measure of political nature is the creation of a transparency mechanism for all consultable to explain the path of money, how much it comes out of fuel subsidies and where it will end up in the various sectors of the budget. Thus, the population sees the benefits.

Fig. No. 1- Example of the transparency mechanism of the flow of funds taken from the subsidy to fuels, to be presented annually to the population

The problem of market structure

Entering the economic area there is a question that is raised and should be confronted. It is evident that the termination of fuel allowance will increase their prices.

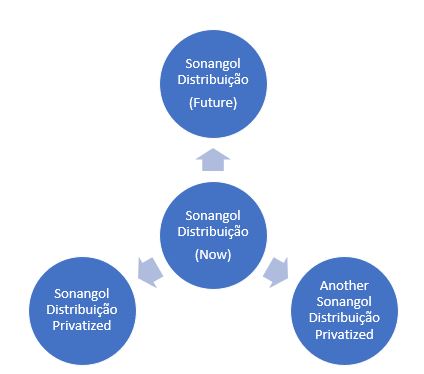

In 2021, there were 951 gas stations in Angola, of which 432, would be controlled by small operators without brand. Sonangol Distribuidora is the largest in the distribution segment with a market share (sales) of 64%, Pumangol is the second largest player with 24% and the remaining 16% are distributed by Sonangalp and Tomsa (Total Marketing and Services Angola)[3].

The question is the definition of the structure of this market. A first analysis could appear to be facing a competitive market, but the weight of Sonangol and Pumangol, representing a total of 78% of sales market quota indicates that we are facing an oligopolistic type market, where few companies dominate the sector. It is known to price theory that oligopolistic markets have higher prices than perfect competition markets, where no one dominates the market. The oligopoly price is fixed by companies above the price level that would prevail in competition and below the monopoly profit maximizing price level. It is a market structure that constitutes a intermediate case, where there are few companies that compete with each other.[4] Consequently, removing the subsidy of fuel prices in an oligopoly situation would be equivalent at a higher price than the market equilibrium price and to put the population to finance higher profits from fuel distribution companies.

It is fundamental while the gradual withdrawal of prices begins to increase the number of relevant operators in the market and put them to compete with each other, without anyone mastering the market.

The most advisable was to split Sonangol Distribuidora in three different companies and immediately privatize two of them. Thus, we would have at least 5 relevant operators in competition.

Fig. No. 2- Sonangol Distribuição Scheme to ensure competition in the market

Forms of compensation/mitigation of the removal of subsidies

Described was the need to create a fund flow transparency mechanism for political consensus purposes, as well as the need to reform the market structure of the Downstream segment as a way to prevent oligopoly price formation, that is, higher than normal, it is time to make suggestions for compensation for the removal of subsidies.

The starting point is that there will be no savings of all values pointed out as a cost, 2.8 to 3.7 billion euros per year, and that there are sectors and populations that must be protected. We speak, of course, the populations with less income and the areas of transport and food and agricultural distribution.

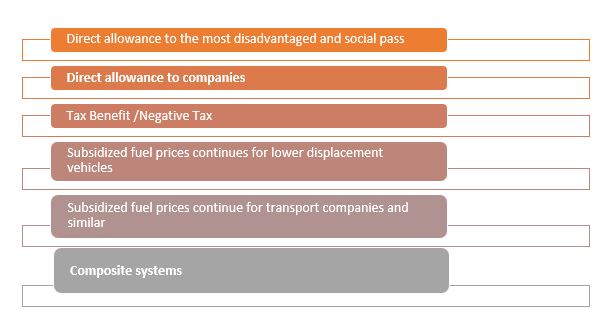

Measures can start from various focuses:

a) Focus on the subject

AA) direct subsidy to the most disadvantaged and social pass

AB) direct allowance to companies

AC) Tax Benefit /Negative Tax to AA) and AB)

b) Focus on the object

BA) Subsidized fuel prices continues for lower displacement vehicles

BB) subsidized fuel prices continue for transportation companies and similar

c) Composite systems

Explaining each of the items and possibilities. We would have the following:

a) Focus on the subject

AA) direct subsidy to the most disadvantaged and social pass

A first hypothesis would be the granting of a fuel subsidy to all those who had a vehicle and/or used fuel in a given activity and showed an income below a given level. This wanted to say that the citizen who used fuel and had low income would receive a direct subsidy of the state in order to alleviating the negative effects of the price of fuel climbing.

In addition, a reduced social pass could be created, allowing any citizen to use transport without repercussion of the amount of fuel climb.

AB) direct allowance to companies

Another hypothesis would be that of direct allowance to transport and distribution companies. So that they did not reverberate the price of fuel in prices charged to the public, there would be compensation paid by the state that would cover the differential. Companies would receive funds so as not to increase prices.

AC) Tax Benefit /Negative Tax to AA) and AB)

In this situation, the instrument used for compensation would be the fiscal system, not the direct transfers of subsidies. It would be allowed to natural persons to a certain level of income and the companies of the affected sectors presented as tax deduction the value of the differential paid with the rise of prices. For example, if they previously paid 5 and then they would pay 10, they would have the opportunity to present an amount of 5 as a fiscal deduction, paying a lower tax.

In a superficial situation, such a deductive possibility would only apply to entities who paid tax, leaving out those who do not pay or are exempt. In these cases, a negative tax should be made, that is, a system through which low-income people would receive supplementary government payments rather than pay taxes. These supplementary payments would be equal to the additional amounts spent on fuel by these people.

b) Focus on the object

BA) Prices of subsidized fuel continues for lower displacement vehicles

In this hypothesis, what would happen would be the establishment of different levels of price for fuel according to the displacement of vehicles. Low-displacement vehicles would pay a lower price and vice versa. It would be a kind of progressive price.

BB) subsidized fuel prices continue for transportation companies and similar

In this case, the system would be the same as indicated above, with the difference that the beneficial price would be applied to the vehicles of transport companies and similar.

c) composite system

It is evident that the above systems can be mixed or complemented by each other, and it is up to the political decision-making to find the best technical combination.

Fig. No. 3- Possible compensatory solutions for the removal of subsidies to fuels

Need for financial calculations

There are no financial calculations in this work because the numbers are not known. The Minister of Finance presents an order of magnitude of current spending quantity with fuel subsidy, which is between 2.8 and 3.7 billion euros per year. Easily it is found that the differential is too large (900 million euros) to do a finer arithmetic of the situation.

[1] IMF, STAFF REPORT FOR THE 2022 ARTICLE IV CONSULTATION, February 7, 2023, p. 7.

[2] https://angola24horas.com/component/k2/item/26418-governo-angolano-prepara-fundo-de-investimento-imobiliario-para-gerir-ativos-recuperados

[3] Data from Expansão: https://expansao.co.ao/expansao-mercados/interior/sao-951-postos-de-combustivel-e-454-de-bandeira-branca-101135.html

[4] See for example, George J. Stigler, https://cooperative-individualism.org/stigler-george_a-theory-of-oligopoly-1964-feb.pdf