The need for a joint African Union mechanism for Africa’s debt to China

The framework and problems of debt to China in Africa

Africa is a continent that is mentioned many times because of its vast natural wealth. Unfortunately, this is not reflected in the wealth of the African populations, who consequently suffer a variety of deprivations.

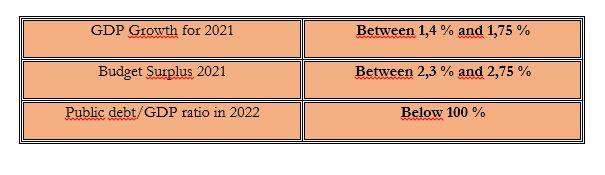

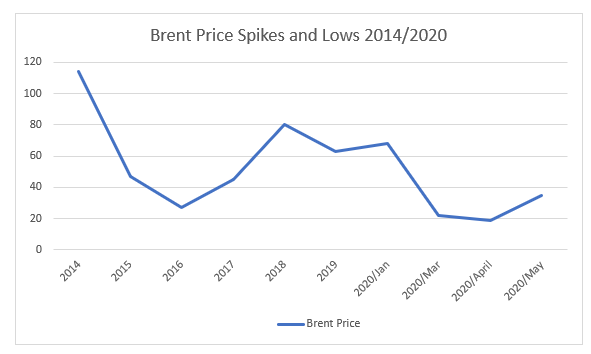

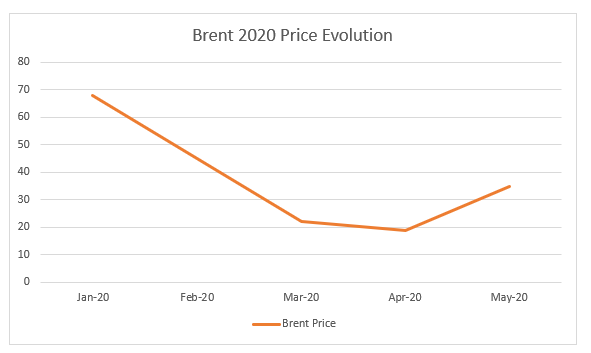

In this context, the issue of the debt owed by African countries to China is taking on somewhat worrying contours. The loans taken out by sub-Saharan African countries from China have seen a major boost, especially since the Road and Belt Initiative (RBI) was established in 2013. This ambitious Chinese initiative, whose main driving force was President Xi Jinping, aimed to increase the country’s economic and geopolitical influence. And while loans grew dramatically in 2013 with 17.5 billion dollars, and even peaked in 2016 with 28.4 billion dollars, in the following years the drop in loan amounts was incessant, reaching 1.2 billion in 2021, and the following year totalling just 994 million dollars (a total of 9 loans), making it the lowest level of Chinese loans since 2004.[1]

Fig.1 – Annual evolution of Chinese loans to Africa (billions of dollars)

Source: Chinese Loans to Africa Database, Boston University

The channelling of this Chinese money into development in Africa, specifically in the financing of various infrastructure projects and other ventures, has stimulated some African economic growth. However, there have been several “grey clouds”, many of which are clearly visible in the Angolan economy, but which also stand out in other countries. This translates into an often undisguised unease in Sino-African relations. Some countries have even become hostages to the so-called “debt trap diplomacy”. China, by unleashing the RBI, provoked the idea of facilitating loans to other developing economy states, and indeed, this ended up making the Asian country the largest international creditor. However, these loans have often lacked transparency: cases of corruption have multiplied, often because the financing did not go through public tender processes. The problem of the so-called ‘hidden debt’ arose when “China stopped lending to central governments and state-owned or state-supported companies. These debts do not appear on government balance sheets, although governments are often responsible for them if the official debtor is unable to pay.”[2]

You might think that this situation could eventually benefit the Chinese, since they have several countries “stuck” with monstrous debts. However, this is not the case, because at the same time, China is facing very serious domestic economic problems, which, until they are solved, will make it difficult to promote a reduction in foreign debt at the same time. [3]

Indeed, the slow recovery from the pandemic, the problem of youth unemployment, and the collapse of the property sector have shaken what seemed to be China’s unshakeable growth. This is how Christoph Nedopil, founder and director of the Chinese think tank Green Finance and Development Centre (GFDC), argues: “it will be a domestic challenge for China to simultaneously promote debt reduction abroad as long as domestic economic problems are not fully resolved.”[4]

In December 2022, Chatham House published a report analysing the development of the model of Chinese loans to African states (2000-2020), which were initially based on providing resources, and then evolved into more strategic or business-oriented choices.

Fig 2: Top 10 recipients of Chinese loans in Africa, 2000-20

Source: Chatham House: https://www.chathamhouse.org/2022/12/response-debt-distress-africa-and-role-china/02-case-studies-chinese-lending-africa

It should be noted, however, that from 2021 onwards the Asian country’s orientation changed, for reasons already mentioned, and also because several states were not meeting their payments. The Chinese leadership changed course and stopped investing in large projects, such as railways and motorways, to focus on smaller loans with a more beneficial social and environmental impact. The climate agenda was another factor to enter the equation.[5]

In addition, the money began to change direction; previously most of the loans went to countries in East and Southern Africa. From 2021-22 there was a shift towards West Africa, with countries like Senegal, Benin and Côte d’Ivoire receiving most of the money.[6]

Many African states and others have defaulted on their debts, so it was imperative that ways were found to resolve China’s so-called ‘odious debt’.

According to the International Monetary Fund (IMF), the world’s most indebted poor countries have all borrowed heavily from China. This situation, as we have already mentioned, may constitute “debt trap diplomacy”, in which China deliberately grants loans to countries it knows it cannot repay, in the hope of gaining political influence.[7]

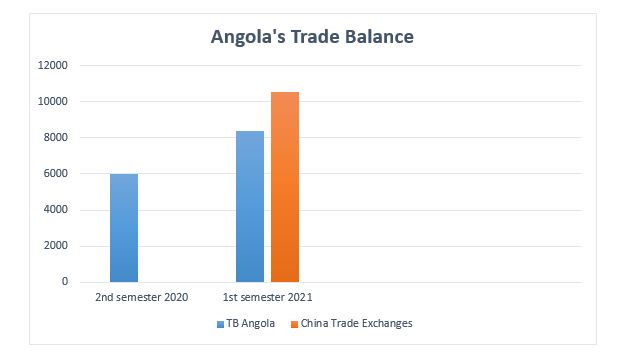

What we saw last year was a growth in Chinese exports to Africa, which reached 173 billion dollars, an increase of 7.5 per cent compared to 2022, while its imports from the continent fell by 6.7 per cent to 109 billion dollars (data provided by the Chinese General Administration of Customs).

Although the annual increase of 100 million dollars made bilateral trade in 2023 a record, Africa’s trade deficit with China continued to rise, from 46.9 billion dollars in 2022 to 64 billion dollars last year.[8]

In 2022, 60 per cent of China’s debtor nations were in financial difficulties, compared to 5 per cent in 2010.[9]

How have some of these African nations dealt with this debt problem, and how has China changed its behaviour over time?

Let’s analyse a few cases:

Zambia:

The Middle Kingdom has been tough in the debt restructuring negotiations, and the situation, despite all the constraints, is not worse because other actors are gaining prominence, not just states, such as economic institutions like the IMF or the World Bank, or organisations that promote international negotiation and dialogue, such as the G20.

In the case of Zambia, which is the continent’s largest copper producer, it was the first sovereign nation in Africa during the pandemic to default when it failed to make a bond payment of 42.5 million dollars. The debt ended up preventing the country from developing economically and taking on new projects. So, in June 2023, Zambia and its creditors, including China, finally reached an agreement within the G20 Common Framework to restructure 6.3 billion dollars in loans.[10] This relief was limited to deadline extensions and a grace period on interest payments, but in order to reach a consensus there were no debt cuts,

However, in November there were already disagreements, as the Zambian government announced that a revised agreement to rework 3 billion dollars in eurobonds could not be implemented due to objections from official creditors, including China.

These problems in restructuring Zambia’s debt, which had been negotiated within the G20 Common Framework, ended up greatly undermining the negotiations and further delaying debt restructuring, putting the lives of ordinary Zambians in ever greater agony.[11]

Ghana:

At the beginning of last year, Ghana owed China 1.7 billion dollars, according to the International Institute of Finance, a financial services trade association focused on emerging markets.[12] Like Zambia, Ghana went into sovereign default on 60 billion dollars in domestic and external debt at the end of 2022 and sought a resolution to this problem soon afterwards under the Common Framework for official external debt of 5.4 billion dollars.[13]

An agreement was reached with the official creditors to restructure the debt, along the same lines as Zambia. However, although this agreement has unlocked an IMF loan, progress has been slow.

Currently, according to some sources, “Ghana intends to carry out a simple debt restructuring, exchanging old bonds for new notes, at a time when the country is seeking to relieve a debt of around 13 billion dollars owed to international private creditors”.[14] However, the information provided has been contradictory, which is why the Ghanaian government has been cautious about a debt overhaul that would include a gradual reduction, in which bondholders would receive less if macroeconomic results were not as good as expected.[15]

Nevertheless, the government has told investors that it would like to reach a solution following the agreement on public debt reached with creditors such as the Paris Club and China.

Ethiopia:

Ethiopia is the second most populous country in Africa and the tenth largest in terms of area, but it is also one of the African states experiencing the greatest geopolitical, military and economic turbulence. The proximity to the Chinese state goes back a long way. Ethiopia recently signed several bilateral agreements with several of its official creditors, including China itself. With low foreign currency reserves, which have been a constant problem in the country, and high inflation, it has reached bilateral agreements to suspend debt servicing. With China, it obtained a two-year debt suspension, which is quickly being cancelled. Ethiopia has 28.2 billion dollars in foreign debt, half of which is Chinese. According to the African Development Bank, Ethiopia’s GDP is expected to grow by 5.8 per cent in 2023 and 6.2 per cent in 2024, mainly on the basis of industry, consumption and investment. On the other hand, inflation reached 34 per cent in 2022. Due to high defence spending and declining revenue collection, the budget deficit was 4.2% of GDP in 2022.[16] Against this backdrop, Ethiopia needs development support, debt relief and Foreign Direct Investment.[17]

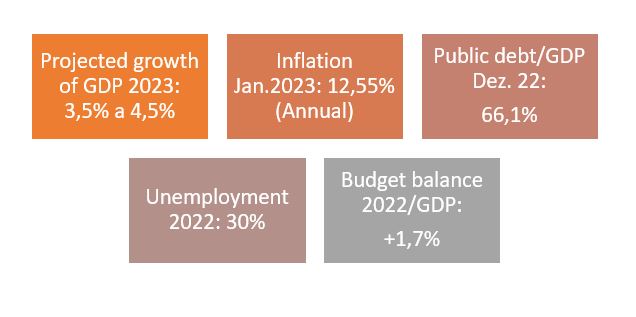

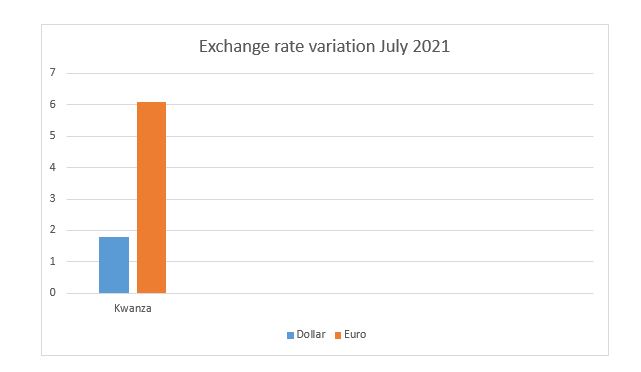

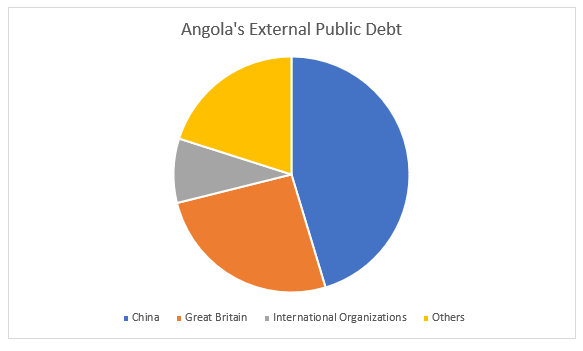

The Angolan situation

Angola’s debt to China is older than the Belt and Road initiative of 2013. It began to develop after the end of the Civil War in 2002, with China becoming the main financier of the reconstruction that followed. At the moment, according to official data from the National Bank of Angola (BNA), Angola’s public debt stock in relation to China is 18.4 billion dollars (billions in Anglo-American terms), corresponding to 37 per cent of the total debt. What’s more, the figures show that between 2019 and 2023 this amount fell from 22.4 billion to 18.4 billion. This means that, in four years, Angola has paid – in capital alone, not counting interest – 4 billion dollars to China[18] . Everyone has noticed the weight that public debt payments have on the state budget, and there were serious problems with Angola’s public finances in 2023, and it is expected that the same will happen in 2024, especially from March onwards, given the need for payments to China.

Although we don’t believe that the payment of the debt to China jeopardises the solvency of the Angolan state, we do believe that it has a very significant crowding out effect, since it removes resources from the General State Budget that could be earmarked for development and the social sector to pay off debt, debt that is controversial to some extent, since the loans were used in a very questionable way: Part of that debt was earmarked for disposable infrastructure, such as stadiums and roads that today are in a precarious condition. In addition, a significant portion of these loans ended up being privately appropriated by Angolan leaders, damaging the country’s economy.

There is a clear Angolan problem with Chinese debt, which, as we have just briefly described, also exists in relation to other African countries.

Fig. 3 – Chinese loans to Africa and Angola (in USD$ billion)

Source: China Africa Research Initiative – Johns Hopkins University (https://www.sais-cari.org/)

The creation of a common mechanism within the African Union (AU) to negotiate Chinese debt

Since the Chinese debt is an African issue, it should no longer be dealt with bilaterally, as it is clear that each state on its own may be too weak to negotiate with China, one of the world powers of today, or to appear alone in the organisations promoted by the creditors. The creditors unite, while the African countries face them individually without support.

It would be important for the Conference of the African Union, the AU’s supreme body made up of heads of state and government (Article 6 of the AU’s Constitutive Act), to set up a Joint Chinese Debt Negotiation Committee (Article 6(d)), mandated to negotiate with the Chinese authorities a global framework for readjusting Africa’s debt to China, which would then be applied to all those seeking debt relief.

It is clear that negotiating Africa’s debt with China is a complex process that involves interaction between different parties with different interests and objectives. In order to achieve success, it is essential to consider African unity in demanding Chinese co-operation. This unity means, from the outset, gathering information and obtaining as many elements as possible for the negotiation, which a joint body can facilitate. In complex negotiations, time and the ability to understand the other person are fundamental aspects, and in this sense, a unified African solution will allow for a much greater exchange of experiences and, at the same time, a more technical, less emotional and more ‘negotiatingly’ weighty follow-up to the negotiation.

It is essential that Africa draws up a joint policy to deal with Chinese debt on an equal footing and not from a position of weakness.

A clear solution is to pass all the negotiations through a united African body within the African Union, becoming an enlarged African Union-China negotiation. This would also make it possible to strengthen the unity of the cradle continent.

[1] https://www.reuters.com/world/africa/chinese-loans-africa-plummet-near-two-decade-low-study-2023-09-19/

[2] Africa Defence Forum Magazine: https://adf-magazine.com/pt-pt/2022/02/dividas-com-a-china-colocam-20-paises-africanos-em-dificuldades-financeiras/

[3] https://www.bbc.com/portuguese/articles/cmj544lg205o

[4] idem

[5] https://www.voanews.com/a/china-s-lending-to-africa-hits-a-low-study-shows/7280214.html

[6] idem

[7] Visual Capitalist: https://www.visualcapitalist.com/countries-loans-from-china/

[8] South China Morning Post: https://www.scmp.com/news/china/diplomacy/article/3250552/china-africa-trade-hit-282-billion-2023-africas-trade-deficit-widens-commodity-prices-key-factor

[9] Visual Capitalist: https://www.visualcapitalist.com/countries-loans-from-china/

[10] Associated Press: https://apnews.com/article/zambia-debt-restructuring-deal-china-a0d14e7af986e2f873555685cedb86b3

[11] Afronomics Law: https://www.afronomicslaw.org/category/african-sovereign-debt-justice-network-afsdjn/one-hundred-and-fourth-sovereign-debt-news

[12] https://www.reuters.com/world/africa/china-says-its-official-bilateral-loans-are-less-than-5-ghana-debt-2023-03-02/

[13] Economist Intelligence: https://www.eiu.com/n/china-and-africas-long-road-to-debt-recovery/

[14] https://www.reuters.com/markets/rates-bonds/ghana-pushes-simple-debt-rework-proposal-bondholders-sources-2024-01-30/

[15] idem

[16] Observer Research Foundation: https://www.orfonline.org/research/the-changing-face-of-ethiopia

[17] idem

[18] Rui Verde, https://www.makaangola.org/2024/01/angola-eua-trump-e-divida-a-china/