Boosting tourism in Angola

1- Framework: the requirements and agents of tourism promotion in Angola

Angola is gradually seeking to diversify its economy, choosing tourism as one of the main priorities for structuring economic policy. As is well known, the reconstruction started from 2002 did not focus on tourism, but on the oil, mining and construction industry. Once this model was exhausted, diversification became the keyword for development.

Since it is conspicuous that Angola has an enormous tourist potential, the truth is its implementation implies the removal of sveral obstacles and the creation of adequate conditions. We refer to two essential axes to create these conditions: the first is the creation of favorable conditions for investment in the tourism sector, this implies the review of the investment law that has already taken place, the removal of barriers to market entry and the facilitation of bank credit for new projects.

The second axis is of an infrastructural nature and requires the creation of an adequate transport network, roads, planes and boats, as well as a climate of criminal security, in addition to the facilitation of tourist visas.

Figure 1: The 2 axes for the development of tourism potential

Furthermore, the growth of tourism cannot be solely dependent on the State, it is naturally responsible for the regulation, supervision and creation of infrastructure and conditions. However, the fundamental role belongs to the private business community, which must advance and establish partnerships to enter the international circuits. And, finally, it is also up to the provincial, municipal and communal leaders to encourage and leverage their resources.

State, businessmen and local leaders form the tripartite partnership that must come together to launch tourism in Angola.

In 2019, at the opening of the World Tourism Forum that took place in Luanda, the President of the Republic made it very clear what the executive wanted for the sector: within the framework of the diversification of the economy, tourism should play a role in promoting development and generating income and employment. For this to materialize, the government should invest in the short and medium term, in the expansion of hotel infrastructures and in the infrastructure of the tourist centers of Cabo Ledo, Calandula and the Transfrontier Project of Okavango Zambeze, with the purpose of increasing the offer and the options diversity of tourists and customers in general[1].

Recently, a possible crisis in tourism in Europe has been discussed, admitting that Greece, Italy, France, Spain and Portugal are affected by the sanctions on Russia resulting from the war in Ukraine (which, in relation, at least to Portugal, is doubtful, as the country was not dependent on Russian tourism), Egypt has not yet fully recovered from fear of bomb attacks, Indonesia struggles to contain Muslim fundamentalism, India struggles with rising pollution levels, Kenya and Senegal could be invaded by Islamic agitation, favorite destinations like Turkey, Israel, Thailand and Dubai are somewhat saturated. This scenario is described in a somewhat emphatic way, however, it opens up opportunities for tourism in Angola, as it represents a certain verifiable trend.

The country has potential in tourism to attract tourists, as Cape Verde and Botswana did; it has paradisiacal beaches, desert and forests, rivers of great flow, mountains, exuberant fauna and flora, and, above all, a welcoming people and a rich and varied gastronomy.

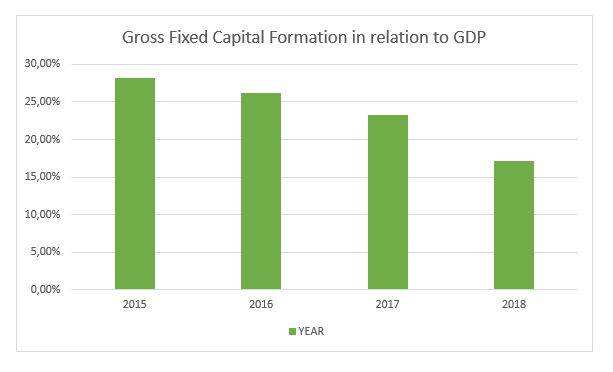

2-Scenario of Angolan tourism

There is no developed tourism industry in Angola. The few areas that are developed took advantage of the country’s natural beauties, rivers, waterfalls and the 1,650 km of Atlantic coast. As the official brochures describe: “The humid tropical climate [of Angola] has created an exuberant flora and rich fauna spread over regions with forests, savannas, impressive mountains, rivers, beaches that seem to stretch without limits, waterfalls, oases and beautiful landscapes which seem to go on to infinity and are all immaculate and intact. An endless summer of warm afternoons bathed in warm breezes to contemplate adventure and discovery.”

Angola has an extreme natural beauty that reveals itself as a promising tourist destination. Mussulo Island and Cabo Ledo are examples of places with an immense capacity to attract tourists, as well as several areas of the provinces such as Namibe, Benguela, Malanje and Cuanza-Sul. The Calandula Waterfalls in Malanje are particularly impressive.

However, currently, most foreign travelers arriving in Angola are not tourists, but entrepreneurs, workers and consultants. This means that hotels are geared towards business and not tourism or leisure. As businesses have been through a serious crisis since 2015, that only now (2022) is truly emerging, that is to say that in recent years there has been a markedly low occupancy rate in hotels, which went from 84% in 2014 to 35% in 2017 and 25% in 2018. This drop in occupancy reflected the crisis that overshadowed the country, not the lack of interest in tourism. The drop in oil prices that has occurred since 2014 and until last year led to a decrease in economic activity in Angola, which resulted in fewer business travelers occupying hotels.

Those responsible recognize that there are currently major weaknesses in the tourism sector, namely “lack of concrete support and incentive measures, difficult access to places, potential resources and tourist attractions, lack of appreciation of tourist resources, lack of flexibility of the banking system to finance tourist projects, deficit in terms of hotel and tourist training establishments, excessive dependence on imports, due to the deficit in domestic production, lack of tourist culture, lack of greater openness in granting entry visas to the main tourist-issuing markets of the world and reduced purchasing power of Angolans[2]”.

However, these unsatisfactory numbers and facts do not represent any structural trend. Between 2009-2014 Angola registered strong growth in the hotel sector with revenues exceeding 45 billion kwanzas (100 million euros at the time exchange rate), creating around 223 thousand jobs. Thus, there is clear potential for the tourism business.

3-Touristic locations and potential markets

Angola has numerous tourist attractions, among which we can highlight the national parks of Kissama and Iona, Quedas de Calandula, Ruacaná, Mussulo, Miradouro da Lua or the Zambezi River.

It is possible to promote the development of hotels and tourist resorts aimed at vacationers in some of the areas specifically intended for sun, sea and sand tourism, such as Cabo Ledo, 120km from Luanda in the municipality of Quiçama, which has 2,000 hectares of enormous beauty and is a potential location for world surfing, once visa processes are facilitated.

Another alternative for nature tourism is Calandula, Malange, which has the most impressive waterfalls in Angola and is the second largest in Africa at 150 meters high and 401 meters wide. An area of 1,978 hectares of endless vegetation and waterfalls as far as the eye can see and which has an enormous potential for tourist investment: tourist accommodation, restaurants, entertainment, golf and casinos.

The idea of a museum route also emerged. The initiative of this route is to awaken and increase the culture of visiting museums, in order to create a heritage identity. This route includes the Iron Palace, the National Museum of Military History (Fortaleza São Miguel), the National Museum of Natural History and the National Museum of Slavery, passing through several hotel units. This route should serve as a model for implementation in all provinces of the country.

The target markets for Angolan tourism should be Russia (after the peaceful resolution of the war) and China, which are now the countries from which more than 50% of international tourists come, Angola has everything it takes to absorb a substantial share of these markets. Furthermore, as mentioned above, it could absorb some European demand, especially in the area of adventure and new ecological experiences.

4-Strategic axes and special tourism areas (STA)

As mentioned above, the strategy for tourism must be based on two axes: the promotion of investment and the creation of infrastructure.

We recognize that there is a new favorable climate for investment and also an effort, especially within the scope of the CPLP, to make the bureaucratic process of issuing tourist visas more flexible, that is, conditions are being developed for a new strategy for attracting tourists.

According to an Angolan official, the documents required for the licensing of tourist developments were reduced, from 11 documents previously required to three. The validity of permits was changed from three to five years, the process of decentralizing the permit issuance system is in progress. All these actions aim to improve the business environment in the tourism sector. Regarding visas, the same official points out that the process was already more difficult. He made it known that there have been significant advances, which need to be improved, to attract more tourists[3].

The same officials argue that in terms of infrastructure there are gaps that are easy to solve; Catumbela Airport (Benguela) may be equipped with mechanisms to receive direct international flights, transport is part of the investment that is up to the private sector, the Benguela Railway line passes hundreds of meters from the airport, connects to Zambia and to the Democratic Republic of Congo and goes to Tanzania on the Indian Ocean, Lobito has a large-capacity port, and the expansion itself is providing parallel investments in health, training, services, and the capacity to produce skilled and competitive labor.

At the government level, tourism is recognized as a strategic sector in the National Development Plan 2018-2022, as a guarantee of intensive labour, alongside agriculture, various industries and fisheries. The National Development Plan includes some specific actions, such as the improvement of communication with the Tourist Development Poles, the elaboration of projects for the construction and rehabilitation of hotel and tourist infrastructures, state and mixed infrastructures, the identification of priority development areas, with the aim of recovering and developing the entire heritage of the hotel and tourist network.

Another government official, who has since ceased his duties, underlined that in addition to Angola starting to reduce restrictions and bureaucracy, as part of the strategy to relaunch tourism and promote the attraction of investment to the sector, he wanted to draw attention for the country, with the collaboration of the international supermodel Maria Borges, who would help to promote the potential. The strategy would involve calling an international name, Maria Borges, to help promote the country’s culture, history and main tourist destinations[4].

With the new strategy for the promotion of tourism, Angola hopes to integrate the list of the main tourist destinations in Africa by 2025[5] .

***

However, it is not possible in the short term to create a complete national infrastructure for tourism. There must be pragmatism and realism in political approaches to promoting tourism in a country where tourism has been almost non-existent. It is in this sense that the best solution must be dual and with different deadlines.

In the medium term, a national tourism strategy should be developed. However, in the short term, there must be a focus on what we will call Special Tourism Areas (STA). The STAs would be five areas of the country in which the State in partnership with the private sector and local authorities would focus to create infrastructure and specific conditions for tourism. Areas with easy access, hotels, restaurants, guaranteed security and maybe free transit visas to visit these areas. Preferred areas chosen to test the STAs could be Malanje, a beach area with urban animation, a paradisiacal-style beach area, and a city with a lot of history or an area with ecological interest aimed at European tourists.

Figure 2: Special Tourism Areas

These areas would have privileged tax treatment and the elimination of visas should be considered for those who went there for up to 15 days. This proposal would imply the elimination of visas for foreign tourists from the target markets who travel to the STAs for a maximum period of 15 days in tourism. All they need to do is present a return flight ticket and proof of booking in tourist accommodation.

There would thus be the creation of pilot districts dedicated to tourism, small capsules of what could be global tourism in Angola in the future.

Conclusions

Tourism can be one of the areas of excellence in the ongoing diversification of the Angolan economy, as it is a sector where the country has enormous potential. The investment in tourism must be a tripartite work of the State, private business and local communities. Target markets will be Asia and Russia (after the Ukrainian War settlement), as well as eco-tourists or European adventurers.

For tourism to exist in Angola, investment conditions must be provided (which is ongoing) as well as adequate infrastructure in physical terms and easy to move around.

It is advisable to proceed in the short term with the creation of Special Tourism Areas that work as pilot experiences for tourism promotion. Areas that will bring together hotels, restaurants, local entertainment, security and easy access, and elimination of visas for tourism in the STAs. And then with the results of these STAs extend to the entire country.

[1] https://e-global.pt/noticias/lusofonia/angola/angola-joao-lourenco-aposta-em-turismo-para-diversificar-economia-do-pais/

[2] https://www.jornaldeangola.ao/ao/noticias/os-resultados-da-estrategia-para-o-turismo-ainda-sao-incipientes/ – interview with ANGOP by the general director of Infotur – 31-08-2021

[3] https://www.jornaldeangola.ao/ao/noticias/o-futuro-de-angola-repousa-no-turismo-e-nao-no-petroleo/

[4] https://pt.euronews.com/2021/06/28/as-apostas-de-angola-para-relancar-o-turismo

[5] https://www.jornaldeangola.ao/ao/noticias/o-futuro-de-angola-repousa-no-turismo-e-nao-no-petroleo/