Indications and Summer Forecasts for the Angolan Economy

Indications

The latest figures available from the National Institute of Statistics on the Angolan economy point to a decrease in GDP in the 1st quarter of 2021 in the order of -3.4%, an unemployment rate in the same quarter of 30.5%, and a annual inflation rate for the month of July 2021 of 25.72%[1]. None of these figures that reflect macroeconomic magnitudes are encouraging in the short term.

However, there are other economic and financial realities to consider in order to have a global view of the movement underway in the Angolan economy, and which allow for a more optimistic perspective.

To begin with, in terms of the budget balance and public debt, essential elements of the support program of the International Monetary Fund (IMF), the expectation is that the 2021 budget balance will be positive, possibly above 2% of GDP (further on we will present our prediction). In relation to public debt, as we had predicted in previous reports, its sustainability is consolidated, as recognized by the IMF representative in Angola very recently (see our forecast below)[2].

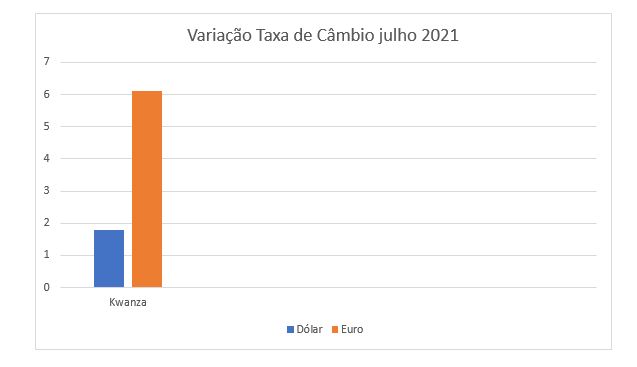

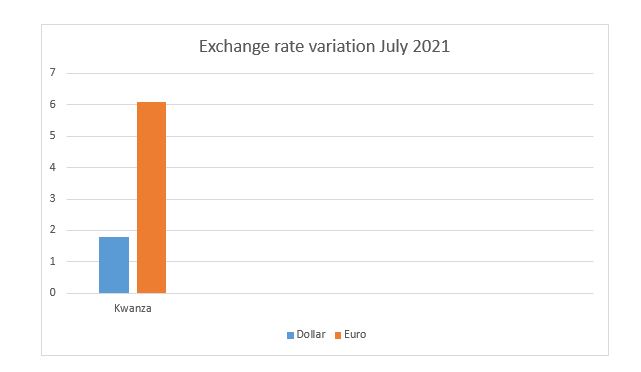

In terms of exchange rate with reference to the month of July 2021, the Kwanza has already appreciated 1.8% against the dollar and 6.1% against the euro, since January 2021, breaking a strong period of strong devaluation started in 2018. Furthermore, 3.5 years after exchange rate flexibility, the gap between formal and informal market rates is below the 20% target announced by the central bank at the time of liberalization, between 7% and 8% for the dollar and euro respectively. Note that at the time prior to liberalization, the same gap was 159% and 167%.

Figure 1 – Kwanza Exchange Rate Variation against the Dollar and Euro (July 2021)

Currently, some sectors are already announcing an increase in the profitability of exports due to the favorable exchange rate policy. This is the case of cement, where Pedro Pinto CEO of Nova Cimangola assures that “To boost exports, the devaluation of the currency helped, because all the costs that the company has in national currency, in dollars, were lower and, in this way, the competitiveness of the company to place products on the international market. In other words, all those products that we continue to buy in Kzs and that have not suffered large price variations in dollars were lower and, therefore, allowed the company to have greater profitability with exports.[3] ”

Also a reference to PRODESI (Program to Support Production, Diversification of Exports and Substitution of Imports), which has generated more than USD 29 million since the beginning of the year. As the main exported products, emphasis is placed on cement, beer, glass packaging, bananas, juices and soft drinks and sugar[4].

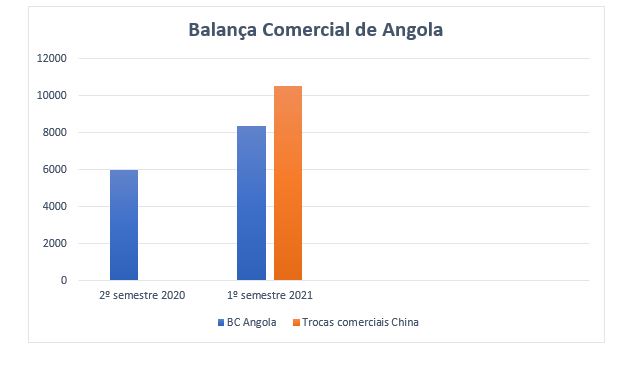

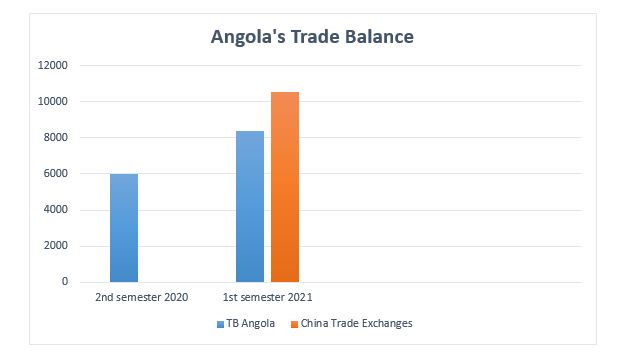

These movements are reflected in the trade balance. Angola’s trade balance recorded, in the 1st half of 2021, a surplus of USD 8,381.9 million[5], an increase of 40.2 % compared to the results recorded in the 2nd half of 2020 (USD 5,978.8 million)[6]. Within this framework, there was an increase in exports of 25%, naturally still influenced by the increase in exports from the oil sector of 28.4%.

Figure 2 – Angola’s Trade Balance and Trade Relations with China

But there is also a significant increase in trade with one of Angola’s main trading partners, China. “Trade between Angola and China increased 23.9% in the first half of 2021, to US$10,550 million (€8,985 million), compared to the same period last year”[7]. According to Gong Tao, Chinese ambassador to Angola, despite the adverse effects caused by the covid-19 pandemic, Chinese companies remain interested in investing in Angola, highlighting the recent construction of factories, one dedicated to the production of tiles and another qualified for the production of energy and water meters.

2021 Summer Forecasts

In modeling the perspectives we present here, several factors are taken into account, among which we highlight the main ones. The first element is the calculation of the oil price (always a determining factor in the Angolan economy). We assume that the price of Brent will maintain a slight upward trend, standing at a level between USD 65 to USD 75 per barrel. A relative stabilization or possible appreciation of the Kwanza against the dollar and the euro is also part of our model, which makes it possible to reverse some of the falls in the past that were merely nominal due to the more flexible exchange rate. We anticipate that the post-Covid-19 world recovery will boost the Angolan economy’s exports, as is already happening with China. Finally, we anticipate that the environment for foreign investment will gradually improve as a result of legislative reforms and the commitment of political power. We have as a recent example the several advertisements coming from Turkey. At the end of July 2021, Angola and Turkey signed 10 cooperation agreements, in the fields of economy, trade, mineral resources and transport, having already announced an increase in the trade balance with Angola to a value of around USD 500 million[8].

From the point of view of obstacles, it is worth mentioning the immense lack of capital. This is the main element for any sustained recovery, and also the inexistence of economic diversification[9] and the persistence of administrative bureaucracy.

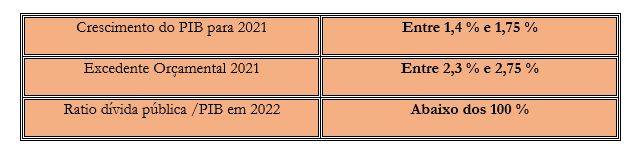

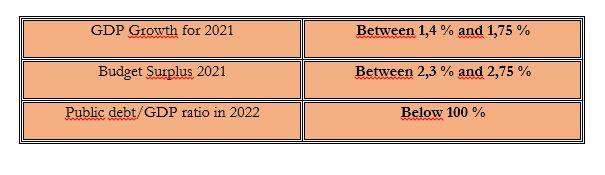

All things considered, our model predicts that by the year 2021 the Angolan economy will come out of recession, and GDP growth will reach between 1.4% and 1.75%.

Our model points to a budget surplus between 2.3% and 2.75%, depending on the evolution of the oil price until the end of the year. And considering the evolution of the Kwanza exchange rate, our forecast is that in 2022, the public debt/Gross Domestic Product (GDP) ratio will be below 100%, achieving greater consolidation.

Figure 3 – CEDESA Model – Forecasts for the Angolan Economy

Consequently, the initial period of strong adjustment and contraction of the Angolan economy is expected to come to an end this year, with no more shocks and global control of the Covid-19 pandemic.

The special case of Unemployment

We understand that unemployment is a special case that should be treated differently, both statistically and in terms of public policies. In terms of statistics, it should be better ascertained who is occupied with informal productive paid activities and who cannot effectively obtain any paid work they want. We should avoid statistical biases that disturb the proper understanding of reality.

On the other hand, it is clear that it will not be the market or the private economy that will solve the problem of lack of employment in the short term, especially for young people. To that extent, the authorities are urged to develop a Keynesian-type employment promotion program, if necessary using available capital from the fight against corruption, as we have advocated in other reports. The state has to spend money on job creation.

[1] Cfr. https://www.ine.gov.ao/

[2] Cfr. https://www.sapo.pt/noticias/atualidade/representante-do-fmi-em-angola-afirma-que_611bf099d1bccf29fd83b48c

[3] https://mercado.co.ao/grandes-entrevistas/a-desvalorizacao-da-moeda-permitiu-que-a-empresa-tivesse-maior-rentabilidade-com-as-exportacoes-XJ1038347

[4] https://www.angonoticias.com/Artigos/item/68811/prodesi-rende-mais-de-usd-29-milhoes-em-exportacoe

[5] https://www.bna.ao/Conteudos/Artigos/lista_artigos_medias.aspx?idc=15419&idsc=15428&idl=1

[6] https://www.angonoticias.com/Artigos/item/68824/balanca-comercial-regista-superavit-de-usd-83819-milhoes

[7] https://www.rtp.pt/noticias/economia/comercio-entre-china-e-angola-recupera-24-no-1o-semestre-apos-forte-quebra-em-2020_n1343994

[8] https://www.angop.ao/noticias/economia/angola-e-turquia-reforcam-balanca-comercial/

[9] Cfr, the most recent elements on the sectoral participation in the GDP that demonstrate the immense and reinforced weight of the oil sector. https://www.bna.ao/Conteudos/Artigos/lista_artigos_medias.aspx?idc=15907&idsc=15909&idl=1