The question of capital in Angola

1- Introduction: IMF, sound economic policies and capital accumulation

Contrary to what some economic studies and forecasts currently carried out by some more or less unknown consultants, the current Angolan economic policy has solid foundations. This is demonstrated by the recent assessment by the International Monetary Fund regarding the agreement between the fund and Angola. The IMF administration is clear in declaring[1]: “The authorities [from Angola government] have supported the [economic] recovery through sound policies that aim to further stabilize the economy, create opportunities for inclusive growth and protect the most vulnerable in Angolan society.”

It would be difficult to have a better endorsement of government economic policy.

However, macroeconomic stabilization and the resumption of economic growth are different realities. There is need of a certain engine to ensure economic growth. It is known that the essential growth model was presented by Robert Solow (Nobel Prize for Economics in 1987), that explains that growth depends essentially on the accumulation of capital, with the increase in GDP resulting from the increase in the capital stock[2].

It is known that the latest Angolan GDP figures for the first quarter of 2021 are negative by 3.4%. So the question that now arises is: how to transform sound economic policies into capital accumulation and promote GDP growth?

2-Capital in the Angolan economy

The essential growth model of the Angolan economy, at least from 2021 onwards, was not a model based primarily on investment, but on consumption derived from imports and on the direct benefit of capital gains from the high price of oil. This meant that the investment that existed was induced by oil and not extended to the economy as a whole[3]. It should also be noted that a good part of the savings gains at that time was not transformed into domestic investment, having been transferred abroad from Angola. In a colloquial way, there was a sharp flight of capital from Angola to overseas countries, namely Portugal or off-shore tax havens[4].

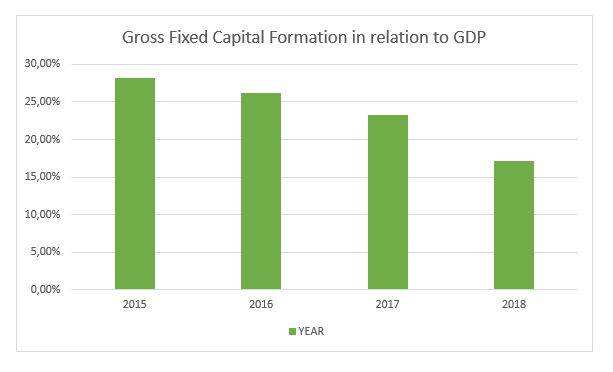

It is public that this model went bankrupt as of 2014, and led to sharp years of recession after 2015. At the same time, it was found that the contribution of gross fixed capital formation (GFCF) to GDP began to decrease from that point on. year (2015). If we look at each year the FCF/GDP was respectively 28.21 %, 26.21 %, 23.24 %, 17.19%. The 2018 number (17.9%) is frightening and makes the discussion about the need to capitalize the Angolan economy more relevant.

Figure 1: Gross Fixed Capital Formation in relation to GDP

“The country has a capital deficit”[5] and this problem has to be resolved so that growth can occur. This aspect has to be one of the guides for future economic policy. A goal must be set to raise the GFCF/GDP rate to higher levels, possibly to the 25/26% that happened in 2007 or 2012, which ensure GDP growth levels (albeit based on oil) of 14% and 8%. Now a new capitalization not only based on oil has to be carried out.

It’s easy to diagnose. Angola lacks capital and needs strong investment. The answers will be the most costly.

3- Increase capital in Angola

What to do to accumulate and increase capital in Angola?

Our answer is divided into two perspectives, the short-term and the medium-term. Let’s focus on the short term, then make a brief reference to the medium term, although it is clear that there is a continuum, as what is done now has repercussions over time.

The executive has already taken some measures, which we have reported in previous reports[6], such as the Private Investment Law (LIP)-Law no. 10/18, of June 26, which no longer requires partnerships with Angolan citizens or companies from Angolan capital and in its article 14, it guarantees that the State respects and protects the property right of private investors; Article 15 establishes that the Angolan State guarantees all private investors access to the Angolan courts for the defense of their interests, being guaranteed due legal process, protection and security. The range of possibilities for transferring dividends were also expanded. Moreover, in administrative terms, it should be noted that in 2018, all requests for the transfer of dividends above five million dollars (4.3 million euros) were granted to foreign companies operating in the country. And, most importantly, since 2020, the capital import from foreign investors who want to invest in the country in companies or projects in the private sector, as well as the export of income associated with these investments, have been exempted from licensing by the Angolan central bank.

However, this is still not enough, and foreign private investment will take a long time, either because a very turbulent electoral period is starting, or because there is a worldwide distraction with Covid-19. In addition, the executive has not yet communicated with all the worldwide amplification, the opening of Angola for business. Even so, it is essential that the executive maintain the political orientation of openness to foreign direct investment.

More needs to be done in the short term to increase investment in Angola and subsequent economic growth. Below is a list of suggestions.

• The initial suggestion is obvious and is based on strengthening public investment. It is essential that the government becomes an inductor of investment and that the capital gains arising from the rise in oil prices and possible apprehensions in the fight against corruption are applied in reproductive investments with short-term results.

The next two suggestions might be more innovative.

Let us address the first of the most unorthodox suggestions. As mentioned, a good part of the savings obtained by Angolans in Angola was remitted abroad, decapitalizing the country. Now we have to reverse this.

• In this sense, the government should, in the first place, sell the dormant shares and assets or in which there is no very relevant strategic interest, which it has abroad. With the result of this sale, it would constitute an investment fund to be invested within Angola. Thus, the first heterodox proposal to increase the capital available in Angola is to sell what there is abroad that belongs to the State (directly or indirectly) and place it in the Angolan economy. Certainly, Sonangol’s position in Millennium BCP should be sold and transformed into investment capital in Angola, and possibly an indirect stake in Galp, if it is not possible to reach a strategic agreement with the Amorim family to better monetize the Angolan position.

• The second suggestion refers to fighting corruption. It is necessary to get out of a certain delay that entered into and boost the capital recovery.

Thus, the government should directly approach those it calls “hornets” and propose a negotiated solution to their situation. Either they deliver the assets that are abroad for investment in Angola, or they will face long prison terms. In relation to these assets, the method outlined above would be followed: Provided market prices were acceptable, everything would be sold and the capital returned to Angola for investment according to a formula agreed between both parties.

This “negotiation” would not be carried out by common means, but by a special force to be set up in Angola and would have short deadlines, not judicial deadlines.

There will have to be a radicalization in both directions in the fight against corruption. More effective punishment or forgiveness with repatriation. Unlike what happened in the previous repatriation law, there would be no waiting, but there would be a proactive attitude on the part of the executive.

By way of an illustration, the participation of Isabel dos Santos in NOS, that of General Kopelipa in the BIG bank and in several hotel developments, the apartments that the former figures have in Estoril, etc., could be sold. The result of these sales would return to Angola where it would be invested in terms to be agreed between the State and the former owners.

These listed measures could give some boost to the Angolan economy and thus promote economic growth immediately.

At the medium-term level, the essential thing is that there is no rampant corruption, good communication infrastructures are created, an investor-friendly legal apparatus and fast, non-corrupt courts, an educated workforce (this does not mean having degree courses but the necessary skills) and reasonable taxes. In short, an inviting political and social climate for investment.

[1] IMF, Fifth review under the extended arrangement under the extended fund facility and request for modifications of performance criteria— press release; staff report, and statement by the executive director for Angola, June 2021, available in https://www.imf.org/en/Publications/CR/Issues/2021/06/30/Angola-Fifth-Review-Under-the-Extended-Arrangement-Under-the-Extended-Fund-Facility-and-461318

[2] Cfr. Recent reassessment and description in Philippe Aghion, Céline Antonin e Simon Bunel (2021), The Power of Creative Destruction

[3] Cfr. Rui Verde (2021), Angola at the Crossroads. Between Kleptocracy and Development

[4] Cfr. For example: Isabel Costa Bordalo, Angola com 60 mil milhões USD é terceiro em África na fuga de capitais, https://www.expansao.co.ao/angola/interior/angola-com-60-mil-milhoes-usd-e-terceiro-em-africa-na-fuga-de-capitais-94979.html

[5] Jonuel Gonçalves (2021), Angola: Não é a Covid que está a provocar a crise económica, https://www.dw.com/pt-002/angola-n%C3%A3o-%C3%A9-a-covid-que-est%C3%A1-a-provocar-a-crise-econ%C3%B3mica/a-58859385

[6] CEDESA, (2020), A nova atractividade para o investimento internacional em Angola https://www.cedesa.pt/2020/03/09/a-nova-atractividade-para-o-investimento-internacional-em-angola/