Analysis of the General Budget Proposal of the State of Angola for 2023

1-Official presentation of the SGB

The proposal of the State General Budget (SGB) from Angola to 2023 has already been delivered to the National Assembly, including its essential elements of an affordable and pedagogical digital page of the Ministry of Finance[1].

The Ministry of Finance in its official note highlighted the following main aspects about SGB[2].

Objectives

The two main objectives of budget policy are the “continuation of national economic growth and the continuation of prudent budgetary management.”

Budget balance and public debt

The budget balance will be surplus in the value of 0.9% of GDP, consolidating the evolution of 2021 and 2022. The public debt ratio in relation to Gross Domestic Product (GDP) is decreasing, and projections for 2022 point a ratio of 56.1% of GDP, manifestly less than 128.7% already registered. The government expects the conjugated tendency to decrease public debt and inflation (which estimates 11% at the end of 2023), finally, to decrease interest rates, promoting economic growth.

Some tax aligners will be maintained such as reducing the VAT rate of basic basket products, which fell from 14 to 5%, and in hotel and tourism (14 to 7%).

Oil price

SGB’s proposal has as reference the oil barrel to USD 75.00.

Sectors expense

In terms of expenditure affectation, 23.9 % for the social sector are budgeted, 10 % for the economic sector, 8.6 % for defense, security and public order while general public services have 12.5 %.

According to the government, social expense represents the largest share of expense in SGB absorbing 43.5% of primary tax expense and 23.9% of total budget expense, with an increase of 33.4% compared to SGB 2022.

Growth

In terms of predictions that substantiate the proposal, the SGB assumes that by 2022, the real GDP should have a positive real growth rate of 2.7%, above the 2.4% initially provided for in SGB 2022, and for the year of 2023, a real growth of 3.3% is expected[3].

Inflation

The government expects to 2022 an inflation of 14.4%, well below the 18%goal. For 2023, it anticipates an inflation rate of 11.1%, as mentioned above.

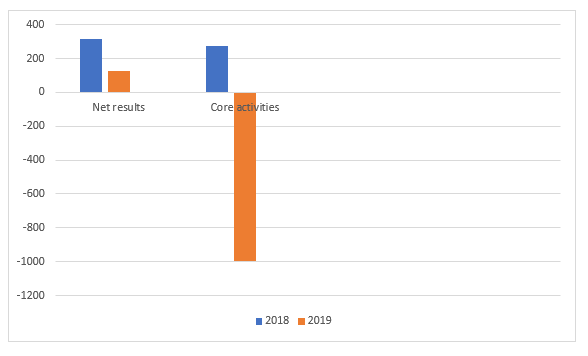

2-The Question of Oil

It is evident that the price of oil still occupies a wide space in the Angolan economy. According to the Ministry of Finance data, in the SGB of 2022, the oil sector represented approximately 25% of the nominal SGB, and it is expected to be 22%[4].

Set the determining role of oil in the economy and in Angolan public accounts, it is repeated that the indicative price calculated for SGB 2023 was 75.00 USD/BBL as an average for the year, with an average production of 1 180.0 MIL BBL/DAY.

At this moment (December 13 2022) the price of the barrel is in USD 79, 03[5] and the trend in markets in recent times has been falling. Last month came from a level higher than USD 90.00 to a limit less than USD 80.00. Obviously, the volatility of oil price is large and no one can make predictions about the predictable evolution of the price. The current fall is attributed to the slowdown of the Chinese economy and the effect of rising US interest rates on commodoties. It may be like this or not, the price may climb or go down. If there is perhaps an expectation of climbing, as it is anticipated that China begins to recover and US interest rates no longer increase, besides OPEC production cuts, the truth is that the budget margin is not too big in Terms of oil price. Quickly, price oscillations can call into question SGB calculations.

In addition, the accuracy of daily production is 1180 thousand barrels, when the average of 2022 was 1 147 in 2022 and 1 124 in what refers to 2021. Given a recognized obsolescence in some sectors of oil production in Angola It may happen that this barrel value is not achieved.

This means that, in our opinion, there will be some optimism in the oil projections in SGB 2023 both at the price level and at the production level. It cannot be said that projections will not be verified, only that some emergency reserve is required for projections not to be consummated.

There is still a very thin line between success and budgetary failure, so a renewed reform of the economy is critical.

3-The Social Expenditure

The government announces as a great success of its proposal the increase in social expense by 33.4% compared to 2022, occupying the largest slice by sector. Realizing, the reasoning report states that social expenditure will correspond to 43.5% of primary tax expense (without debt service), which is 23.9% of total expenditure and an increase of 33.4% compared to SGB 2022, as already mentioned. “In this sector, we highlight education, health, housing and community services and social protection, with weights of 14.1%, 12.1%, 10.1% and 6.2% in primary tax expense, respectively[6].” The truth is that comparing education, health, and housing with 2022, in all these rubrics there is an increase in expense higher than inflation.

Notably is the exponential climb of health and housing over the next year, with increases of 45.1% and 57.6% respectively.

If we notice the 2022 SGB, the social sector represented 38.8% of primary tax expense, corresponding to 19.02% of total expense and an increase of 27.1% compared to SGB 2021[7]. This means that it is manifest that the government is paying special attention and promotion to the social sector that increases year after year. The numbers prove this social attention of budget policy.

However, as is well known it is in the social sector that the complaints of the population often appear. There is a problem that is not budgetary, but related to management and rationality. It has to effectively execute the SGB and make the money reach people. The issue is increasingly good management and good governance, competence and deliverance, not the lack of resources.

4- The financial expense related to debt

The debt financial expense is 45.1% of SGB expense, decreasing by 2.6% compared to 2022[8]. In practice, we have a little less than half of the SGB designed to pay debts. We will not wave with the “ghost” of debt failure, which we have referred to over the long analyzes we have made, it does not exist. What worries us is the content of the debt and the fact that the state is supporting and paying a debt that is not his.

As an Angolan press agency specialized in economics and confirms official data, “China remains the country that Angola should most, holding about 40% of the total. Most of the debt to China has as its main creditor the China Development Bank (CDB), as a result of a USD 15 billion financing, as part of an agreement signed in December 2015.”[9]

This 2015/2016 Chinese loan is one of the most issues one must pay attention to and has a specific approach.

Our argument is that part of Angolan public debt is what is doctrinally called “odious debt.” The legal doctrine of “hateful debt” argues that sovereign debt contracted without the consent of the people and that it does not benefit it is “hateful” and should not be transferable to a successor government, especially if creditors are aware of these facts in advance[10]. We do not fight for non-full payment of this debt or others to China or another country (also offers us many doubts the debt enrolled in favor of the UK, but we will leave this theme for another occasion) or entity, but a bi-volunteer renegotiation with the respective Haircut of capital and interest that manifestly relieves the weight of the debt.

Consequently, there should be a profound forensic audit to this 2015/2016 Chinese loan whose destination has never been very clear, except in vacancies that would be applied at Sonangol, at a time coincident with the assumption of the company’s management mandate by Isabel dos Santos. After this forensic audit and according to the results obtained there should be a very serious renegotiation of debt with China. In 2015, China already had more than enough elements to know that part of its borrowed money was being poorly applied. In fact, this is the year when its supposed representative, Sam Pa, was apparently detained. The country, as a great power it is, cannot be hidden behind legal formalism and has to face together with Angola the problem of its debt that was diverted by corruption.

5-Conclusions

It is evident that there is an economic policy effort to exist financial rigor and budgetary control according to the injunctions of the International Monetary Fund, externally credible the country in economic terms. Alongside this financial rigor that cost João Lourenço quite electorally in August 2022, there is attention to the social sector, trying to mitigate the financier.

This budgetary policy is correctly formulated, the question to be aware is within the scope of the realization and execution. It is essential that social expense comes to those who need it and in the frontline structures: doctors, nurses, hospitals, schools, teachers, etc., and do not stay in intermediate consumption and corruption shortcuts that act as funds siphon. In other words, it is imperative that budget public money is not diverted. And then it becomes imperative to control the affectation and application of the funds. The task of good management and governance is the most important in the SGB of 2023.

At the level of resources it is relevant to emphasize that the oil activity (price and quantity produced) optimistic is relevant to us, to this extent, it is important to have a contingency reserve for low price and production.

And in relation to public debt in the face of China (and other entities) we argue that certain forensic audits are required and if something similar to a “hateful debt” is glimpsed, mechanisms of profound renegotiation are activated. Ultimately, it would have to bring the matter (“debt hatred”) to the United Nations pursuant to articles 1 (3) and 14, among others from the United Nations Charter to create a consensus on international law on the subject.

[1] Ministério das Finanças de Angola: https://www.minfin.gov.ao/PortalMinfin/#!/materias-de-realce/orcamento-geral-do-estado/oge2023

[2] Ministério das Finanças de Angola: https://www.minfin.gov.ao/PortalMinfin/#!/sala-de-imprensa/noticias/11811/proposta-de-oge-2023-entregue-a-assembleia-nacional

[3] Relatório Fundamentação OGE 2023 https://www.ucm.minfin.gov.ao/cs/groups/public/documents/document/aw4z/mzg4/~edisp/minfin3388777.pdf

[4] Relatório Fundamentação OGE 2023, p.17

[5] Cotações Brent Crude, 10:33 H, 13-12-22 https://oilprice.com/

[6] See note above, p. 52.

[7] Relatório Fundamentação OGE 2022, https://www.ucm.minfin.gov.ao/cs/groups/public/documents/document/aw4z/mjk2/~edisp/minfin3296952.pdf ,p.5.

[8] Relatório Fundamentação OGE 2023, cit., p. 53.

[9] Mercado, https://www.angonoticias.com/Artigos/item/72530/angola-deve-quase-52-mil-milhoes-usd-ao-exterior-jornal-mercado

[10] Michael Kremer & Seema Jayachandran, Odious Debt, Finance & Development, IMF, June 2002

Volume 39, Number 2