Angola 2050 Strategy – an analysis (I)

Angola 2050

Angola 2050[1] is the name of the strategic plan recently presented by the Angolan government containing the country’s long-term vision.

In general, surprisingly, the reception to the document was lukewarm, it did not arouse particular enthusiasm or was quickly dismissed as lacking in rigour, not having an adequate methodology, or being nothing more than the work of academic consultants.[2]

In our opinion, this document is too important for the future of Angola to be hurriedly put aside, especially given the fact that it has been put out for public consultation, which we applaud.

To that extent, we went to read and analyse the document. It is a work of 432 pages and 11 chapters, elaborated in a professional and systematic way. We understand that even when criticising, the first correct attitude is to study and reflect on the document, besides making it known. Only by knowing the document can one criticise or present alternatives.

The role of civil society, academics and public opinion in general must cease to be mere deconstruction and become one of demand and attentive criticism. Only if we know what we are talking about can we call on the leaders to comply or to present other solutions.

It is our aim to present two papers on the document, the first of which is this one on the methodology, diagnoses and reference scenarios (p.7 to p.19). The second will be on the programmatic content of the plan.

Methodology and principles

The strategy presented by the government claims to be a “bifocal plan, with a clear vision of what is intended for the Country in the future, but articulating in a clear and decisive manner the short-term initiatives that ensure the right direction” (p.7).

It seems to be the best methodology, since there is no point in creating expectations for 30 years from now, without concretizing the steps to get there, and to that extent, the insertion of short-term measures is positive, having the advantage of being able to syndicate the evolution of the path outlined by the plan. It will be easy to conclude whether there is a need for correction or not, by looking at the short term and the plan’s recommendations.

In fact, there is no point in making long-term plans without constant evaluation and correction, there has to be sliding planning.

This was one of the main methodological failures of the previous plan, Angola 2025[3] . It did not materialize, and now (as we shall see below) it is said to have essentially failed.

Also to avoid the shortcomings of the previous plan, the government claims to propose a realistic plan, based on facts. It also informs us that the plan is aspirational, having resulted from extensive consultations that included civil society, academia and the private sector. As a principle, it is clear that this inclusiveness is desirable and conducive to the construction of an adequate plan.

However, taking into account the reaction of Heitor Carvalho, economist and coordinator of the Centre for Studies and Research of the Universidade Lusíada de Angola, or the lack of knowledge of the debate on the subject in the Economic and Social Council created by the President of the Republic, and also the public ignorance of the collaboration of prominent economists such as Yuri Quixina or Carlos Rosado de Carvalho, or even the fact that we, who have been publishing a volume on the Economy and Politics of Angola since 2020, which always sells out, were not called upon to give an opinion, all these facts raise questions about the non-state sectors that were heard. The consultation should have been more comprehensive.

As we will see, one of the main criticisms that this plan makes to the previous one is the excessive nationalization. Now, de-statisation should start at the genesis of these works, seeking the largest number of contributions, even to create consensus from the largest number of actors in civil society and academia.

Finally, the document ensures that it sought sustainability, following a holistic approach, which “integrates solutions for the various sectors, and recognises the interdependence of economic development, social inclusion and environmental sustainability” (p. 8), focusing on feasibility so that the proposed initiatives are achieved.

The failure of Angola 2025

One of the most interesting aspects of the initial part of the document is the courageous assumption of the failure of the previous Angola 2025 plan, all the more courageous because some of those responsible then are the same as now.

The government states that in relation to the Long Term Strategy 2025 (“Angola 2025”) “an important part of the economic and social goals fell short of what was expected, with the previous strategy inadvertently promoting policies that had negative impacts on our development”. (p.9).

Therefore, the current government, besides admitting the flaws of the previous plan, additionally recognises that some of the policies implemented were harmful to the country.

This assumption of responsibility and guilt is important because it should allow the same mistakes not to be repeated.

Essentially, the government points out that one of the main mistakes of the past was the promotion of the state “as the main economic agent, dominating most sectors of the economy and leaving a minor role for the private sector.” (p.9).

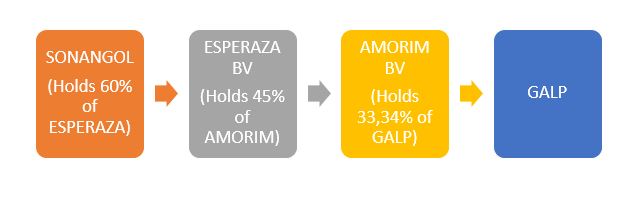

Moreover, the ‘state has unintentionally discouraged long-term, high-quality investment at times’ (p.9). Those familiar with the difficulties of investing in Angola in the past, from the need for local partners to the difficulties of expatriating capital, understand these statements. Indeed, it seemed that Angola did not want foreign investment. Indeed the document itself acknowledges this, when it writes “[the] Foreign Direct Investment, which outside the oil sector was mostly incipient, was sometimes seen as a threat to national investors rather than as a boost to the economic fabric.” (p.9).

Obviously, the risk of corruption also kept many investors away. While there is no doubt about the new presidential discourse on combating corruption, the doubt that remains is about the effectiveness of the mechanisms adopted. It is a fundamental point for the future.

Another aspect raised was that in most sectors of the economy, “competition was harmed, with higher prices and lower quality goods or services often being provided to our citizens, making the country too dependent on the oil sector for exports and for access to foreign currency.

This is another point to which particular attention must now be paid. Many observers speak of new economic actors taking the place of old actors, but only replacing them, and not fostering real competition. What is crucial is to abolish market barriers and promote real internal competition (on free external competition we have a position reserved for another work).

The summary of the previous plan is that more than 60% of the indicators set for 2015 were not achieved. This says it all.

Human development, capital and productivity

The initial part focuses on some themes that we consider important. The first of which is human development. Although it highlights some progress, it recognises that “Human Development is very dependent on the income dimension and penalised by the degree of economic and social inequality, reflected in one of the lowest Human Capital Indices in the world (Angola is in the 4th quartile, below Sub-Saharan Africa and SADC)” (p.10). As we have been saying, and it is important to emphasize, the diagnosis made by the authorities is courageous and objective, not “sugarcoating” reality. It may be that the acknowledgement of failure is the first step towards a successful policy.

At the same time, labour productivity is also found to have declined, largely due to the reduced contribution of ‘capital accumulation’. In turn this lack of capital was “largely related to the fact that Private Capital was allocated to, on average, unproductive purposes and Public Capital was responsible for a very considerable level of investment in infrastructure, but which did not have the expected economic return.” (p. 14).

Once again we have objectivity in our analysis. José Eduardo dos Santos’ policy of ‘primitive accumulation of capital’ was a fiasco, because those who accumulated capital did not invest it in Angola. As we know, capital flight to Europe and assorted offshores was the rule, thus sabotaging what might have been the best intentions. That is why the fight against corruption has a strong economic impact. It is necessary to repatriate capital and guarantee its investment in Angola, whether capital obtained in the past or in the present.

In turn, public investment must stop obeying obscure interests and be seen from a cost-benefit perspective.

Challenges

In light of the above, the government identifies three key issues to be taken into account (p.15):

“Firstly, a set of implicit and explicit disincentives to private investment (e.g., the over-dimensioning of the State’s presence in the economy; difficult access to credit; poor infrastructure quality; lack of human capital quality) that justify the reduced contribution of this item to the country’s economy (excluding the oil sector) and explain the fact that the weight of foreign direct investment in Angola is among the lowest among peers.” We could not agree more.

“Secondly, a two-speed model of economic development, where there is an urban cluster of productive and developed and / or limited competition service sectors employing about 20% of the population, contrasted with informal and / poorly productive sectors employing 80% of the population.”

We have many doubts about this assertion, especially about the so-called “formalisation” policies of the economy. And, also, we do not see ourselves in a model of balanced growth of the economy. It seems more appropriate to follow a path of unbalanced development, since development manifests itself in specific points or poles of growth and then spreads throughout the economy (cf. for example Albert Hirschman )[4]

“Third, an under-investment in human capital, with the ‘quality factor’ (representing productivity potential) comparing particularly negatively with countries of similar income, placing Angola as one of the worst performers on the World Bank’s Human Capital Index.”

It is true that human capital is fundamental, but above all it is necessary to obtain capital. It is a mistake to think that qualifications are enough for a country to grow. A direct link between education and the economy has not been established. “The direct and simple relationship that delights commentators and politicians – expenditure between education and economic growth – simply does not exist”[5] . The question arises more at the level of practical training. The population must have adequate levels of practical and vocational training, and educational attainment should not be confused with the quality of human capital.

Education

The report states that “the biggest social gap – which could significantly constrain future productivity – is in education, especially in the quality component (where Angola has some of the worst performances in the world, below the average for SADC or sub-Saharan Africa)” (p.12). In this regard, it points the focus to the “profound improvement in the quality of the education system, which today is one of the most serious constraints on the country’s growth (Angola is currently in the 4th quartile in this dimension – World Bank classification, having one of the lowest results in the world)” (p.16).

This is a truth, which, however, should not lead to wrong policies. Wrong policies can be exemplified by believing that it is enough to graduate people en masse from university to achieve economic growth. There is no relationship between one fact and the other. The issue is deeper and implies a complete review of the current Angolan education system, from teaching methods to degrees and preference for social and human areas, in addition to the lack of rigour and commitment in many universities. It is a whole programme.

Conclusions

This is a courageous report in its diagnosis of past economic policy mistakes and Angola’s lack of significant progress in many areas essential to human development and capital accumulation.

Once the diagnosis is made, the question is whether the right policies are being chosen and, above all, whether there is the political will to implement them.

[1] MEP, (2023), Angola 2050, https://www.mep.gov.ao/angola-2050

[2] Cfr. VOA, (2023) Estratégia “Angola 2050” ante dúvidas sobre sua elaboração e resultados expectativas, https://www.voaportugues.com/a/estrat%C3%A9gia-angola-2050-ante-d%C3%BAvidas-sobre-sua-elabora%C3%A7%C3%A3o-e-resultados-esperados/7103882.html

[3] MP (2007), ANGOLA 2025. Angola – a country with a future. S u s t e n t a b i l i t y, e q u i d a t y, m o d e r n i- t y. http://www.ucm.minfin.gov.ao/cs/groups/public/documents/document/zmlu/mdmz/~edisp/minfin033818.pdf

[4] HIRSCHMAN, A. O. The strategy of economic development. New Haven: Yale University Press, 1958 and also PERROUX, F. Note sur la notion de Pôle de Croissance. Economie Appliquée, v. 7, pp. 307-320, 1955.

[5] WOLF, A. (2002) Does Education Matter?: Myths About Education and Economic Growth. London, Penguin.