Sonangol. Oil or energy company?

1- Introduction. Sonangol’s privatization and the oil market

On June 15, 2021, at 16.00, the sale price of Brent oil (which serves as a reference for Angola) was USD 73, 45[1] . A month and a half ago, the price was around USD 66.00, and in recent times there has been a sustained rise in the price, as we had predicted in a previous report[2]. If we notice, when we made this forecast (June 2020), the price of oil was situated at USD 36.6. In practice, in one year the price doubled.

However, the government has put forward more details on Sonangol’s partial privatization. The Minister of Mineral Resources, Oil and Gas, Diamantino Azevedo, repeated[3] his promise to approve the schedule for the sale of 30% of Sonangol’s capital on the stock exchange during the current presidential term, explaining that it will be a staggered process, and that there will be several available tranches: “stocks for Sonangol workers, stocks for Angolans who are interested and for strategic partners who later want to become partners”, a model that we defend in due course[4].

A third element to consider when analyzing Sonangol’s is the energy transition. In the United States and Western Europe, at least, this has become something of a recurring mantra forcing oil companies to modify their strategies so that they are less dependent on oil and contribute to a “green” economy. Sonangol finds itself at this crossroads between the need to recover its old aura, to be privatized, but not just relying on oil.

This report will analyze the possible solutions that the Angolan oil company has and point out some strategic paths.

2-The two determining forces in Sonangol’s strategy

There are two somewhat opposing forces regarding the strategy Sonangol may adopt in the future.

The first force “glues” the company to the oil price and aims to keep it as an oil company. In this view, what Sonangol must do is focus on its “core business” – oil – and then become efficient. Therefore, in this context, Sonangol’s restructuring is focused on achieving profits in the oil business, making profitable investments in the area and increasing as much as possible, at the lowest cost, in oil production. The essential measures taken by the current government with a view to reorganizing the company are in this direction. As Minister Azevedo said: “The first measure we took was to free (Sonangol) from the concessionary function, which could create conflicts of interest. We could not take a company with a concessionary, regulatory and business function to the stock exchange”, and another measure was create an “attractive” company that “encourages investment”, which involved reducing the number of subsidiaries and selling non-nuclear oil companies[5].

The other, somewhat opposite force is the energy transition (the green economy). Here it is argued that Sonangol should not be overly dependent on oil, and that Sonangol should become, as happens with other companies, for example, BP, Aramco or Galp, a global energy company and not an oil company. To this is added the potential of non-oil natural energy resources that the country has, such as sun, water, etc.

3-China, India and the OPEC gap

Contrary to what one might think in a Eurocentric analysis, the answer to Sonangol’s future characterization is not obvious. Much depends on the markets to which Sonangol wanted to allocate its production and on the country’s development needs. If you look at it, the recent rise in the price of oil was essentially “pulled” by China’s renewed oil appetite. According to the Bloomberg[6] financial agency, it was the strong demand for gasoline in China that boosted the need for crude oil. The truth is that China is among the biggest drivers of fluctuations in oil prices and China has been buying oil like there is no tomorrow, as a result, prices have gone up. The question is whether China will continue to drive this rise in the medium term in a way that allows for a sustainable oil strategy in relation to Sonangol.

There are two broad lines to consider in trying to anticipate China’s future behavior. The first is its economic level, while the second is its commitment to the energy transition.

China is not yet at an economic level that corresponds to a rich and developed country. According to data from the World Bank, in 2019, the Chinese GDP per capita is in the order of USD 10,000. For comparison, Portugal, one of the poorest of the rich countries, has a GDP per capita on the same date of USD 23,000 and the United States is at USD 65,000[7]. Countries with GDP per capita identical to the Chinese are Argentina, Lebanon, Bulgaria, Kazakhstan, Turkey or Equatorial Guinea. It is easy to see that China still has a long way to go and will need a lot of energy, especially oil.

China’s oil demand has nearly tripled over the past two decades, accounting on average for a third of global oil demand growth each year. From what we have just exposed, China will continue to lead the demand for oil in the coming decades. However, the pace of the country’s oil consumption will not grow as fast, although it will continue to grow. Over the past two decades, China’s oil consumption has grown by more than 9 million barrels per day (mb / d) from 4.7 mb / d in 2000 to 14.1 mb / d in 2019. China’s oil use should continue to grow, albeit at a slower pace, as China is also investing heavily in renewable energy.

China is the world leader in electricity production from renewable energy sources, with more than twice the generation of the second country, the United States. At the end of 2019, the country had a total capacity of 790 GW of renewable energy, mainly hydroelectric, solar and wind power. China’s renewable energy sector is growing faster than that of fossil fuels, as is its nuclear power capacity. China has pledged to achieve carbon neutrality before 2060 and peak emissions before 2030. By 2030, China aims to reduce carbon dioxide emissions per unit of GDP by more than 65% from the level of 2005, increase the share of non-fossil energy in primary energy use to about 25 percent, and bring the total installed capacity of wind and solar electricity to over 1200 GW. Furthermore, China sees renewable energies as a source of energy security and not just a means of reducing carbon emissions[8][9].

In India, another of the world’s great countries in a process of growth, the situation is as follows: trade relations between Angola and India amount to US$4 billion, of which US$3.7 million correspond to exports from Angola to the Asian country, being 90% related to oil. Angola is currently the third most important African exporter to India, when in 2005 it was not relevant. In 2017, the Ambassador of India issued a statement in which he highlighted: “Trade between Angola and India increased by 100% in 2017.” The thing to remember is that India is becoming a significant partner of Angola through its oil needs.

In terms of GDP per capita, India in 2019 was around USD 2000.00. It is easy to see that the growth that India expects is enormous, even if it does not have China’s ambitions of world leadership, just to reach its current level, it has to multiply its GDP by five. Obviously, this implies a growing need for oil. India was the world’s third largest crude oil importer in 2018, and has an estimated oil import dependency of 82%. India’s economic growth is closely related to its demand for energy, so the need for oil and gas is expected to grow even further, making the sector very investment-friendly. At the same time, India is one of the countries with a large production of energy from renewable sources. As of November 27, 2020, 38% of India’s installed electricity generation capacity came from renewable sources. In the Paris Agreement, India committed to a target of achieving 40% of its total electricity generation from non-fossil fuel sources by 2030. The country is aiming for an even more ambitious target of 57% of total electricity capacity from renewable sources by 2027.

Official data indicate that Angola’s oil production reached, in May 2021, only 34 million 887 thousand 890 barrels, less about one million compared to April. In that month, a daily average of one million 125 thousand 416 barrels of oil was obtained, when the forecast was one million 184 thousand 813. This means that Angola is below the target set by the Organization of Petroleum Exporting Countries (OPEC). ), which was 1 million 283 thousand barrels per day, in May, with subsequent increases.

4- Conclusion: Sonangol’s challenges

Considering all of the above, it is evident, first of all, that there is a large margin for Sonangol to continue to focus on oil, either because not even the quotas defined by OPEC for Angola are met, ie, Angola is producing less than it should in a tight market situation, either because the large potential oil futures markets such as China and India will need plentiful oil shipments.

To that extent, Sonangol should not make the mistake – as some oil companies are doing – of underestimating the potential for growth in the oil market. In the Western world with mature economies, the demand for oil may not feel as strong as in the past, but in fast-growing economies, more oil will be needed, albeit often not as exponentially as before.

There is space and market for Sonangol, as an oil company, to grow. Therefore, Sonangol’s ongoing strategic structuring should focus on producing more oil more efficiently, both in terms of costs and in terms of the environment.

However, this model focused on oil efficiency has to be matched with the enormous potential that is opening up in renewable energies and the company has to take advantage of energy synergies, as many of its counterparts are doing and also China and India.

At the present time, when the intention is to privatize Sonangol from a global perspective, it seems sensible to commit Sonangol to tasks in the area of renewable energies. In fact, to be an attractive company for the international stock market, Sonangol must present itself as adopting the latest trends in oil companies, i.e., also following the needs of the energy transition.

Not abandoning or belittling oil, Sonangol must boldly explore the combined possibilities brought by renewable energies.

This exploration of renewable energies by Sonangol should not start from scratch, but rather seek some sustainability and economies of scale. One hypothesis, which we have already touched upon in a previous report[10], would be a strategic partnership with Galp for this purpose. As is known, Galp accelerated its energy transition process.

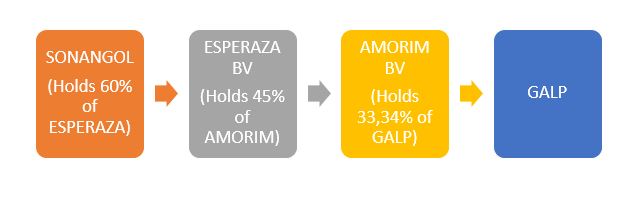

As this hypothesis was not adopted, Sonangol should review the rationality of its permanence at Galp. In fact, at this moment, the Angolan position in Galp is “sandwiched” between Isabel dos Santos and the Amorim family, corresponding to a mere financial investment. This doesn’t make much sense anymore. Either Galp becomes a strategic partner for Sonangol’s energy transition, or a position review becomes required.

The alternative would be for Sonangol to acquire a company that is minimally established in the field and develop its activities based on this new platform. At this time, partnerships have already been announced with ENI and TOTAL to develop projects in renewable energy that will be operational in 2022. Perhaps a strategic focus in this area is more interesting, which would translate into an internal commitment by Sonangol and, as mentioned above, it would go through the purchase or merger with a company operating in the renewable energy sector, to provide initial support for Sonangol.

In short, Sonangol must become a bi-focused company: on oil and renewable energies.

[1] https://www.ifcmarkets.com/pt/market-data/commodities-prices/brent

[2] https://www.cedesa.pt/2020/06/03/angola-petroleo-e-divida-oportunidades-renovadas-2/

[3] https://www.dw.com/pt-002/governo-angolano-admite-privatiza%C3%A7%C3%A3o-gradual-de-30-da-sonangol/a-57879593

[4] https://www.cedesa.pt/2020/01/29/um-modelo-de-privatizacao-da-sonangol/

[5] Idem note 3

[6] https://oilprice.com/Latest-Energy-News/World-News/Chinese-Gasoline-Demand-Is-Driving-Oil-Prices-Higher.html

[7] https://data.worldbank.org/indicator/NY.GDP.PCAP.CD?locations=US

8 Cfr. https://www.oxfordenergy.org/publications/chinas-oil-demand-in-the-wake-of-covid-19/ and

[9] Deng, Haifeng and Farah, Paolo Davide and Wang, Anna, China’s Role and Contribution in the Global Governance of Climate Change: Institutional Adjustments for Carbon Tax Introduction, Collection and Management in China (24 November 2015). Journal of World Energy Law and Business, Oxford University Press, Volume 8, Issue 6, December 2015.

[10] https://www.cedesa.pt/2021/02/10/sonangol-galp-que-futuro-conjunto/