The new attractiveness for international investment in Angola

Introduction

For many years, most international investment in Angola ran into two virtually insurmountable obstacles, which discouraged inversion acceleration.

These two obstacles were the need to count on Angolan partners for any important economic activity in Angola and the difficulties of repatriating investment profits. In practice this meant that the foreign investor risked seeing his share in a business in Angola taken by the Angolan partner and / or failing to recover the money he had invested, as well as the profits. It was a disheartening picture, which only allowed large global companies with sufficient leverage to make investments or encouraged obscure agreements between Angolans and foreigners, which normally took place outside the law.

It is clear that the Angolan economic recovery will have to rely largely on foreign reproductive investment. However, for foreign investment in Angola to become a reality, measures are needed to strengthen the protection of property rights and make financial movements more flexible.

An effort in this direction is being made by the present Government, which must be recognized and encouraged.

New framework for private investment in Angola

We have argued that the Angolan economic model designed since 2002, based on oil exploration and the extravagant stimulus of consumption, did not work. Successful models are generally based on investment (public and private) and exports. This is the path that the Angolan economy should pursue. However, the latest figures have not been encouraging. The indicators of foreign direct investment are bleak, as can be seen in the table below.

Figure 1- Foreign direct investment in Angola. Million USD

In view of this scenario of an abrupt fall in investment that started in 2015, but was more pronounced in 2017, the new Angolan Government, which took office at the end of that year, took several measures to stimulate investment, and above all, remove the mentioned obstacles: weak protection of property rights, mandatory local partner and difficulty in transferring profits.

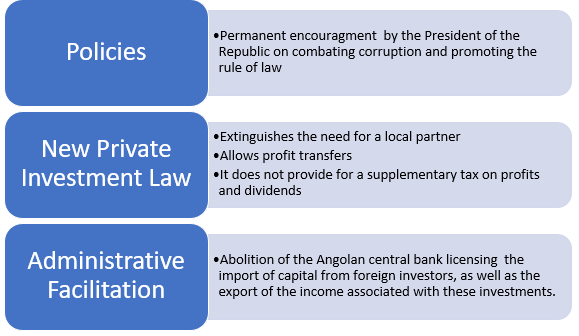

The measures taken were of a political, legal and administrative nature.

- From a political point of view, the President announced an effective policy to combat corruption and increase the rule of law and thereby tried to promote confidence in compliance with the Constitution and the Law, what was not occuring in the past.

- In legislative terms, the NEW PRIVATE INVESTMENT ACT (Law no. 10/18, 26th of June), which no longer requires partnerships with Angolan citizens or companies with Angolan capital, is of fundamental importance. Therefore, there is no longer the antecedent danger in which the Angolan partner, at a certain point, grabbed everything for him. In addition, the NEW PRIVATE INVESTMENT ACT in its Article 14 guarantees that the State respects and protects the private property rights of private investors; Article 15 establishes that the Angolan State guarantees all private investors access to Angolan courts for the defense of their interests, with due process, protection and security being ensured.

- Similarly, the NEW PRIVATE INVESTMENT ACT guarantees the right to repatriate dividends and related amounts without weighing objective criteria or time constraints. And as an additional advantage, there is no provision for a supplementary capital tax rate on dividends and profits.

- In administrative terms, it should be noted that in 2018, all requests for the transfer of dividends in excess of five million dollars (4.3 million euros) were granted to foreign companies operating in the country.

- And, most importantly, since 2020, the importation of capital from foreign investors who want to invest in the country in companies or projects in the private sector, as well as the exportation of the income associated with these investments, have been exempted from licensing by the Angolan central bank.

There is a visible effort by the government to create more attractive conditions for foreign investment, this effort is reflected in the attempt to create a more favourable social and political climate, in the new legislation on private investment and in a greater liberalization of financial movements. The dangers of absorption by the local partner or the impossibility of transferring profits are thus mitigated.

Figure 2- New framework for attracting private investment in Angola

New foreign investments announcements. 1st quarter of 2020

The United States Secretary of State Mike Pompeo confirmed in February 2020 that several US companies are willing to invest more than US $ 2 billion in Angola.

The Africa-Korea Economic Development Association (AKEDA) will contribute US $ 2 billion to finance the construction of a thermoelectric power station in Benguela province, the institution’s secretary-general announced in Luanda, also in February 2020. Siwoo Chung informed that the amount is part of a global amount of US $ 5 billion that the association plans to invest in several projects in partnership with the Angolan State.

The German chancellor, on a visit to Angola, also offered broad support in the development of the country’s infrastructure, in unquantified values.

Swiss-based company Webcor is expanding the grinding company Grandes Moagens de Angola and plans to invest US $ 250 million in five years. Among the investments is a new factory, in the port of Luanda, which transforms 1200 tons of wheat into flour and bran daily. The regional administrator in Angola for the Webcor Group, says that the company has benefited from obtaining faster visas for investors and workers, lower costs and easier rules for investment.

Additional measures needed

It appears that there is a clear focus on the Angolan Government in creating a more attractive framework for foreign investment and that there are already some positive signs. However, this is not enough and additional measures are required, many of which are pragmatic.

- The first measure is communication / information. It is necessary to transmit to the international business community, in a systematic and assertive manner, the new framework for investment in Angola, above all, the positive changes that it has undergone since 2018. This is a vital point, as there is a huge lack of knowledge of what is happening now.

- Secondly, it is crucial to improve the legislation, namely, the one referring to property rights and the land law, seeking to provide the country with clear and effective rules that allow to know what belongs to each one and to avoid the constant disputes over property. . It is also necessary to modify article 19 of the NEW PRIVATE INVESTMENT ACT when it establishes that the transfer of dividends and profits abroad can only be carried out after the complete execution of the private investment project has been confirmed by the competent authorities. A declaration from the private entity that fulfilled these duties should be sufficient, which will be monitored later.

- Finally, initiatives in the area of des-bureaucratization and dematerialization are important, as well as the definitive abolition of licenses by the central bank for transfers related to investment.

Figure 3- Additional measures to accelerate foreign investment