Flashes of optimism in the Angolan economy at the beginning of 2021

0-Introduction. A different focus for Angolan economic analysis

The consulting companies that are dedicated to the study of the Angolan economy follow a conjunctural methodology in which the predominant narrative is based on the negative numbers about the macroeconomic aggregates and their possible perspectives.

However, a more detailed analysis of the evolution of the Angolan economy suggests that behind the numbers of inflation, unemployment, GDP growth and public debt, which are not very encouraging[1], a series of public political reforms are taking place together with the reinforcement of certain economic trends that will indicate the construction of a new, more positive economic reality for Angola.

This study deals with the positive elements that point to the correction of the direction of the Angolan economy in a sense more consistent with the necessary prosperity.

A-Positive trends in the Angolan economy

1-The International Monetary Fund (IMF) and public policy reform

A first element that allows to shed a different light on the perspectives of the Angolan economy lies in the recent assessment carried out by the IMF. In fact, on January 11, the IMF Executive Board concluded the fourth review of the Extended Fund Mechanism Agreement for Angola and approved the disbursement of an additional USD 487.5 million[2].

The important thing in this decision is the IMF’s positive assessment of the reform of Angolan public policies. The IMF states that: “The [Angolan] authorities achieved a prudent budgetary adjustment in 2020, which included gains in non-oil revenues and containment of non-essential expenses, while preserving essential spending on health and social security networks. The approval of the 2021 budget in December consolidates these gains. The authorities have also allowed the exchange rate to act as a shock absorber and have begun to implement a gradual shift towards monetary restraint to face increasing price pressures [3]”.

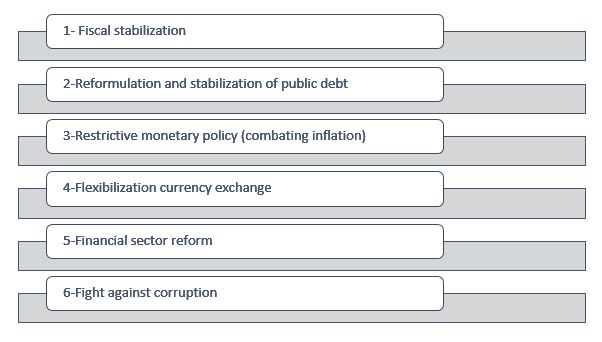

According to what the IMF explains, the economic policy followed by the Angolan government is developed in the following vectors:

-The stabilization of public finances, which is the cornerstone of the authorities’ strategy. In this regard, the government achieved a strong fiscal adjustment in 2020. In addition, its budget for 2021 consolidates non-oil revenue gains and the containment of budget expenditures for 2020, while protecting priority social and health expenditures.

These advances help to reduce the budget’s dependence on oil revenues.

– Reformulation and management of public debt. The government has implemented debt profile reform agreements, in addition to benefiting from the extension of the Debt Service Suspension Initiative until the end of June 2021, which will provide significant debt service relief and help reduce risks related to debt sustainability. We will elaborate below on the reformulation and management of public debt.

-Restrictive monetary policy and exchange rate easing. After easing the monetary constraint to mitigate the shock of COVID-19, the National Bank of Angola (BNA) began, once again, to face the increase in inflationary pressures through the tightening of monetary policy. A more gradual tightening of monetary policy is needed to reduce inflation. Exchange rate flexibility served as a valuable buffer during the crisis. Efforts are underway to develop a liberalized foreign exchange market.

-Reform of the financial sector. Continued progress in financial sector reforms was critical, especially the completion of the restructuring of the two struggling public banks. The timely adoption of the revision of the BNA Law and the revision of the Financial Institutions Law is the key to continuing this progress.

Finally, the IMF highlights the fundamental aspect that underlies all political reform, which is the maintenance of the fight against corruption.

What can be seen clearly from this IMF assessment is that the government is pursuing a reformist policy based on the assumptions made by this international organization, and is implementing difficult reforms.

It is known that many of these IMF policies have an initial recessive effect, especially fiscal consolidation when it involves raising taxes and cutting wages and subsidies, as well as restrictive monetary policy to fight inflation. It is therefore no wonder that the first result of adopting IMF policies is recession and not growth.

What is expected is that this “housekeeping” creates the conditions for a sustained and virtuous growth of the Angolan economy.

Fig. Nº. 1 – Economic policies of the Angolan government celebrated by the IMF

2-Management and careful reformulation of public debt

The executive followed an appropriate strategy when initially negotiating with China the issue of public debt. As we described in previous reports, the Chinese debt is key to Angola, as it represents about 50% of external commitments[4]. Consequently, it was important, first of all to ensure the appropriate terms with China, although they are not public knowledge, apparently imply a three-year suspension of payments agreement. The adherence already mentioned to the IMF’s debt suspension program allowed the government room for maneuver. It should be noted that the Eurobonds on which a lot has been written and pointed out various dangers, has a smaller weight in the total Angolan debt, around USD 8 billion, thus not having, on the contrary, what one could think of exaggerated pressure on Angolan finances in this area.

So, for now, the issue of public debt pressure seems to be eased and within the government’s management capacities.

3-Meridian oil price recovery

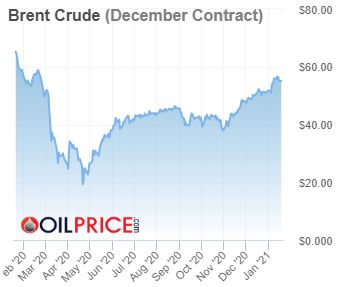

As we had also anticipated, after an abrupt drop in the price of oil at the beginning of the pandemic (March 2020) there would be a rise[5], which is gradually happening.

The reality is that following a trend that was already very clear at the end of the year, the barrel of brent finally reached a price above $ 55, a value that had not been reached since the end of February 2020, the month before the start of the pandemic. Still being the most relevant indicator for the Angolan economy, and considering that the budget for 2021 was calculated based on USD 33 per barrel, we have a financial margin of more than USD 20. This is an additional “cushion” in the management of Angolan public finances.

It is clear that it is not known for how long this rise in the price of oil will continue. The commitment of the new Biden administration to the Paris Agreement, the evolution of the Chinese economy, the decision to cut or increase production by Saudi Arabia and the maintenance of the restrictions resulting from the Covid-19 pandemic are factors that may imply a further decline in the oil price.

Therefore, movements in the oil price are always unknown and these moments of increase must be used by the government to reinforce its reserves for future reproductive and social investments.

Fig. No. 2- Evolution of the Brent price since February 2020

4-Decrease in imports of food basket and agricultural production with continental relevance

The diversification policy combined with the promotion of the national industry through the substitution of exports has been another “motto” of this government. This policy allows in one fel swoop to reduce external dependency and create a thriving national industry.

While it is still untimely to draw any definitive conclusions about the results of this policy, some figures emerge that can be encouraging, at least in relation to the dependence on imports and foreign exchange spending on foreign trade.

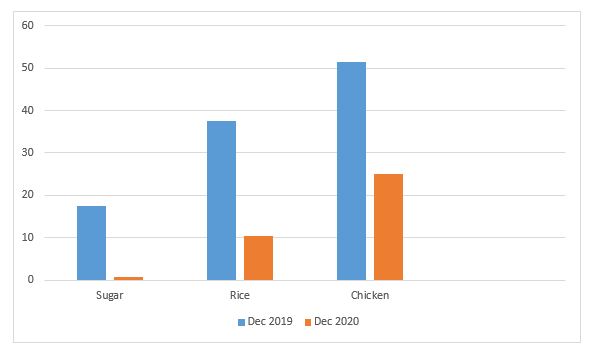

According to data provided by the Ministry of Industry and Trade, Angola managed to record a reduction of almost US $ 100 million in the import of products from the basic basket and other essential goods in the last month of 2020, compared to the same period in December 2019. In December 2019, the Government disbursed US $ 250 million for imports, while in the same period of 2020, it only spent US $ 152 million[6].

In particular, it is worth noting the reduction in sugar imports, which went from 2.1 million tons in 2019, at the cost of 17.6 million dollars, to 1,472 tons, at the cost of 831,121 dollars. Regarding the importation of current rice, in 2019 Angola imported 136,985 tons in the amount of US $ 37.2 million and in 2020, only 59,505 tons, in the amount of US $ 10.5 million. In what concerns chicken (the most consumed meat in Angola), it is also worth mentioning a considerable reduction, compared to 2019. In that year, 46,385 tons were imported, for US $ 51.5 million, whereas last year, only 32,447 tonnes were acquired, for a value of just over US $ 25 million.

Fig. Nº. 3- Comparison of annual imports of basic basket products (Dec.2019 / 2020 in USD million)

These are just some of the products highlighted in the considerable reduction in imports, however this trend has proved to be general in the remaining products that make up the basic basket.

For these numbers to be considered a success, it is necessary to compare them with the internal consumption of the same goods, and understand if the decrease in imports was due to a substitution by domestic products or only reflects a decline in demand as a result of the economic crisis.

In the latter case, although they represent savings in foreign exchange, they do not mean a success in politics, but a decrease in the quality of life of the population. However, even in this situation, national investors should be alert to proceed with investments in these areas in order to correspond to future demand growth.

Statistics published by the Angolan Ministry of Industry and Trade and released by the Portuguese news agency Lusa show the enhanced sustainability of some Angolan agricultural production.

Angola asserts itself as a continental-level agricultural producer. Angola is the largest African banana producer and the seventh in the world with an offer of 4.4 million tons, according to the latest table of the United Nations Food and Agriculture Fund (FAO). It should be noted that the banana continues to be the most produced and consumed fruit in the world. Angola, in particular, has declared itself self-sufficient in banana production for more than six years, with emphasis on the provinces of Bengo and Benguela. In these provinces, private companies already export the fruit to countries such as Portugal, Zambia, Democratic Congo and plan to bring the fruit to the United States, the world’s largest consumer[7].

In relation to cassava, Angola has an annual production estimated at more than 11 million tons of cassava, being today the third largest producer in Africa, after Nigeria and Ghana, and wants to bet on its transformation into starch[8].

5-New investments and exports. Two examples: Rio Tinto and Gold

The finance minister recently told Reuters: “We are building a future (through our reform program) that prioritizes direct investment (not just with China, but with other partners). We want to add value for our economy to create jobs. We want the money to stay. Borrowing is an option, but we are trying to change the way we relate to our partners [9]”.

Thus, it appears that the government is betting on direct investment to revive the economy and also to increase exports.

There are two recent examples that are important to underline in this context. The first is the entry of the powerful multinational Rio Tinto into the Angolan market. Apparently, such a perspective will materialize this year[10].

Also important is the first export of gold mined in Huíla in 2020, in the amount of sixteen hundred and ninety-six ounces sent to Portugal and the United Arab Emirates, which corresponds, at the current price, to more than three million dollars. Obviously, what is relevant is not the amount of gold exported, but the beginning of a trend. As with the entry of Rio Tinto, it is important to mark a trend that brings other big investors like Anglo-American or DeBeers.

None of these investments is very firm yet. Their reference is important because they can represent future axes for the development of the Angolan economy, now in the beginning.

Fig. nº 4 – Signs of optimism in the Angolan economy

B-Necessary policy adjustments

The foregoing demonstrates that the Angolan government pursues an economic reform policy based essentially on the IMF’s revenues: i) budgetary balance and debt control, considering financial solvency as a sine qua non for economic growth; ii) restrictive monetary policy to control inflation; iii) flexible exchange rate policy, allowing for a devaluation of the currency that encourages exports and hinders imports; iv) investing in investment and the private sector as engines of the economy.

Basically, the policy followed corresponds to what was once called the Washington consensus[11]. This is the standard reform package adopted by the IMF, World Bank and the US Treasury Department since the late 1980s and which corresponds to a liberal model of the economy, based on fiscal prudence and the free market.

Naturally, this model has potential for Angola, but it is not enough. There are not strong enough institutions in Angola yet to guarantee the functioning of a free market in which some do not end up dominating others and creating oligopolistic and inefficient situations, as there is not a private sector strong enough to become the engine of the economy.

Making Angola’s economic reform dependent on reforms inspired by the Washington Consensus is not enough, a broader view is needed.

This broader view should imply structural institutional reform. This means that property rights must be clarified by abandoning the confusion that the collectivization of property has generated and still generates, courts must be put in place, bureaucracy is no longer an obstacle, and obviously great corruption must be eradicated. In addition to structural institutional reform, it should be realized that the State has a role to play in this new phase. There is no robust private sector in Angola, nor can everything be delivered to foreign investors with short-term perspectives. A mix should be found between the state and the private sector. In fact, this is how the most advanced Western countries work, despite rhetoric. It is important to adopt the concept advanced by Mariana Mazzucato of Entrepreneurial State[12].

The point to consider in economic reform in Angola is that the role of the government, in the most successful economies, went far beyond creating the right infrastructure and setting the rules. The State is a fundamental agent to achieve the type of innovation that allows companies and economies to grow, not only by creating the “conditions” that allow innovation. Instead, the state can proactively create a strategy around new areas of high growth before the potential is understood by the business community by financing the most uncertain phase of research in which the private sector is risk-averse, seeking new developments, and often even supervising the marketing process.

In addition, the IMF’s recessionary policies, while necessary, must be offset by other types of policies that alleviate the socially depredating burden of those. In short, there must be a mix of reformist policies that is more comprehensive and adequate to Angola, so that in the end the first flashes of success have sustained results.

C-Conclusions

It is necessary to look beyond the negative conjuncture numbers of the Angolan economy and understand that there is a reformist economy policy that is beginning to bear fruit and to mark some new trends. This policy has been applauded (and possibly advised) by the IMF, and here lies its strength and weakness. Strength because it contains some indispensable measures to clean up the Angolan economy and launch it on the path of growth. It also strengthens because its adoption and implementation brings the praise and support of the IMF and sister organizations. However, this policy also has weaknesses, including the lack of attention to institutional reform, the weakness of the private sector in Angola, the recessive effects of contractionary policies, among others.

Consequently, with signs of optimism in the medium-term perspectives of the Angolan economy, it is necessary to improve the economic policy that is being followed, including the intensification of institutional reforms that ensure that the judiciary works, bureaucracy does not hinder, corruption does not divert resources. In addition, the role of the State as an entrepreneurial partner in the private sector should be reviewed.

[1] See the most recent figures: Unemployment 34% (III quarter 2020), Annual inflation 25.19% (December 2020 / December 2019), GDP growth -5.8% (III quarter 2020) at https: // www. ine.gov.ao/

[2] https://www.imf.org/en/News/Articles/2021/01/12/pr216-angola-imf-executive-board-completes-4th-review-of-the-eff-arrangement-approves-disbursement

[3] idem

[4] https://www.cedesa.pt/2020/05/05/porque-a-china-deve-reduzir-a-divida-de-angola/

[5] https://www.cedesa.pt/2020/06/03/angola-petroleo-e-divida-oportunidades-renovadas-2/

[6] https://www.noticiasaominuto.com/mundo/1663059/angola-importou-menos-100-milhoes-de-dolares-de-produtos-da-cesta-basica

[7] https://www.plataformamedia.com/2020/12/15/angola-e-o-maior-produtor-de-banana-em-africa-ha-seis-anos/

[8] https://www.noticiasaominuto.com/economia/1663123/angola-e-terceiro-maior-produtor-africano-de-mandioca

[9] https://www.minfin.gov.ao/PortalMinfin/#!/sala-de-imprensa/noticias/8787/angola-prioriza-investimento-directo-nao-apenas-com-a-china

[10] https://mercado.co.ao/negocios/diamantifera-endiama-quer-concretizar-entrada-da-rio-tinto-em-angola-HC1004823

[11] https://piie.com/commentary/speeches-papers/what-washington-means-policy-reform and https://web.archive.org/web/20170715151421/http://www.cid.harvard.edu/cidtrade/issues/washington.html

[12] See https://www.wook.pt/livro/the-entrepreneurial-state-mariana-mazzucato/19312561