Angola: Oil and Debt. Renewed opportunities

Abstract:

Although Angola is suffering several economic shocks due to Covid-19 and the drop in oil prices, in addition to the nominal increase in public external debt, the truth is that the situation does not present the seriousness indicated in some studies.

Oil: The country is well prepared to benefit from the recovery that is already taking place in the oil price, and which is likely to accelerate with the global unlockdown.

Debt: The debt problem results essentially from the depreciation of the currency and its solution lies in a political negotiation with China, which holds about half of the external public debt.

Diversification: The present difficulties are a real incentive, and not merely rhetorical, for the beginning of the diversification of the economy, made possible by the liberalization measures of the economy.

In recent times, a lot has been written about the Angolan oil crisis, presenting catastrophic forecasts for the country’s economy and the evolution of oil exploration. To the pressure of oil, it has been added strain on public debt, all in the Covid-19 packaging.

The situation being serious, it is not desperate, and several data must be considered analytically with sufficient distance.

The public debt

The issue of public debt, which we have already addressed in a previous report with regard to China (https://www.cedesa.pt/2020/05/05/porque-a-china-deve-reduza-a-divida-de -angola /), does not have the danger that is attributed considering only a formal analysis of the numbers.

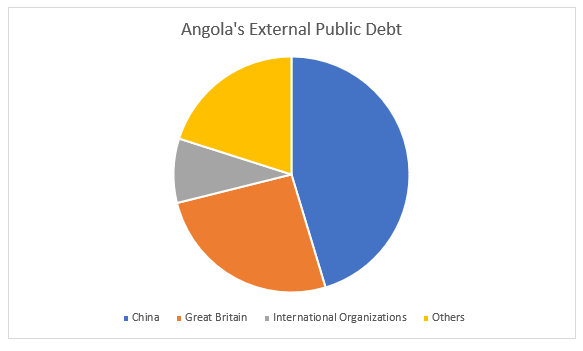

If we look at the most recent data from the BNA[1], Angola’s big creditors are China, Great Britain and International Organizations.

The sum of these creditors equals approximately US $ 39.4 million and is equivalent to almost 80% of the external public debt.

Figure No. 1-Stock of Angola’s public external debt by countries. Source: BNA (bna.ao)

Obviously, the debt to China is eminently political and cannot be seen as an ordinary debt. It should be noted that the Angolan Foreign Minister is already in talks with his Chinese counterpart on the subject[2]. Therefore, there is an effective development in this area.

In some ways, the same is true for International Organizations. It is public that International Organizations, led by the International Monetary Fund, are proposing several relief measures regarding the debt burden of the most fragile economies and emerging markets[3].

However, there is still Britain’s debt. Part of this debt comes from companies based in London, but with privileged relations with Angola and which have a long-term perspective, as is the case with Gemcorp[4], so here too we will have to handle with some caution the overly general statements about the severity of the weight of the Angolan debt.

Furthermore, the International Monetary Fund itself recognized in December 2019 that about four-fifths of the nominal increase in Angolan debt was due to the depreciation of the kwanza and not to new liabilities[5]. Hence, any analysis of the Angolan public external debt that does not disaggregate its elements is wrong.

Clearly the external public debt is concentrated in a few creditors that have several considerations to take apart from those strictly financial, and depends a lot on the attitude of China.

In short, unless an additional extraordinary event occurs, the issue of Angolan foreign public debt is not as serious as it might appear to be a mere nominal observation, and should not become an obstacle to development. The key is in talks with China on the topic. And obviously, China will not want to appear as a negative agent in Angola.

Oil

The same analytical exaggeration has occurred with regard to oil and Angola. Obviously, Angola has an excessive dependence on oil, and that, at this moment, the price of crude is subject to two negative pressures: the fall in demand due to Covid-19 and an apparent secular tendency to decrease oil consumption, replacing it by alternative sources.

Two of the most renowned analysts of these issues in relation to Angola, Agostinho Pereira de Miranda and Jaime Nogueira Pinto[6], have, however, devalued the excess of anguish in relation to this issue in what concerns Angola. We tend to subscribe to this position.

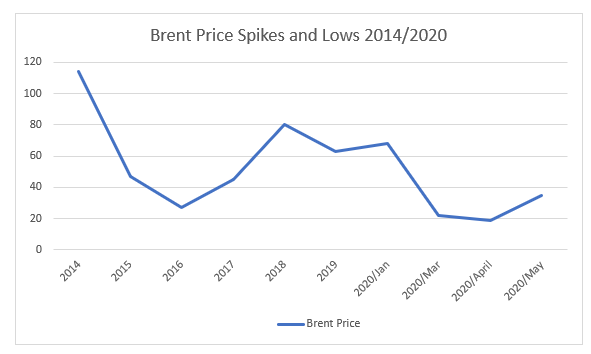

The shock of oil in the Angolan economy has persisted since 2014 (see fig. No. 2) and is a problem for which the government since 2018, has taken several measures that focus on two strategies: i) modernization and opening of the oil sector and ii) promoting the diversification of the economy.

Regarding the first element, it is worth mentioning, among others, the creation of a regulatory agency different from Sonangol, allowing this company to focus on its core business, the privatization of Sonangol’s secondary subsidiaries and the signing of agreements with several foreign companies to increase investment. In fact, the big companies, including Total, Exxon, Chevron, BP, ENI, planned to operate more drilling vessels in Angola than anywhere in the continent to explore new discoveries. In relation to diversification, there has been more rhetoric than practice, but the need, as we will see below, will force it to be put into practice, provided that the government effectively liberalizes the economy.

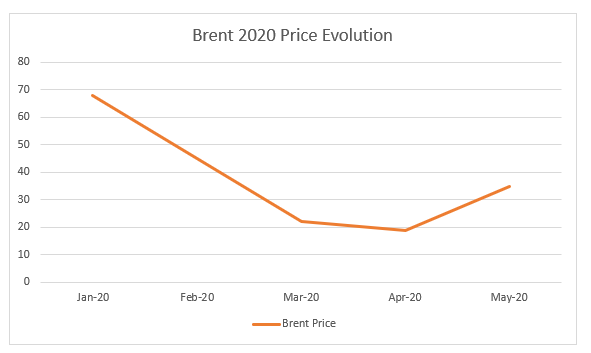

Meanwhile, Covid-19 made oil prices dip and foreign companies stopped their activity in Angola[7]. However, despite the immediate bad news, the situation will tend to stabilize at a higher level. Moody´s at the end of May announced that it foresaw a future generic level between USD 45-65. It is not a question of relying on the accuracy of these figures, but only of noting that there will be an upward trend.

Consider the price of Brent. At the moment, it stands at USD 36.6 (May 22nd, 2020[8]). Therefore, it has already risen from the minimum number reached on April 21, 2020, USD 19.33. The value of USD 36, 6 is already above several levels reached after the abrupt fall in 2014. For instance, in the beginning of 2016, the value ranged between USD 29 to 32. This means that the price of oil seems to enter, at the present moment, again in some normality, besides that since 2014, the country is already used to dealing with a great oscillation in the markets.

Figure No. 2- Brent USD Peak / Barrel Price Peaks and Lows (Nasdaq and Oilprice.com source)

Figure no. 3 – Price evolution of Brent 2020 (Sources in fig. No. 2)

It also should be pointed out that a good part of Angolan contracting is reversed in long-term contracts, so price fluctuations do not necessarily affect public treasury immediately.

In addition, very soon, there will be a time when economies close when the demand for oil has decreased substantially, to a relaunch of economies. Whether this recovery in V, U, W or another letter, the truth is that it will imply an increase in the demand for oil, which will probably increase the price of oil as long as the “wars” between Russia or Saudi Arabia do not restart. or other similar events.

In addition, the low value of oil will be an incentive for its use in an economic recovery phase in which concerns about clean but more expensive energies will, in the short term, be replaced by the need to put companies to work and people with a job.

Even if concerns about the climate emergency persists in Europe, it is difficult to see that the major engines of the world economy, such as the United States, China and India, do not prefer a cheap source of energy that quickly gets plants up and running.

Angola has already started to anticipate and still in the week of 25-29 May, the National Agency of Petroleum, Gas and Biofuels (NAPGB) made available, a data package for oil exploration of the terrestrial basins of the lower Congo and Kwanza, for nationals and internationals companies. These are the blocks CON1, CON5, CON6, KON5, KON6, KON8, KON9, KON17 and KON20, whose official announcement, for the start of new bids, will be made in the coming days.

In a nutshell, the organizational reforms, of rationalization and increase of the oil market underway in Angola, combined with the gradual recovery of oil prices, in the context of the relaunch of the world economy in the post-Covid-19 period, allow us to believe that the oil sector in Angola has good conditions for recovery, and remove the most pessimistic scenarios.

Opportunity for diversification

A final note on the diversification policy that has been proclaimed constantly by Angolan leaders, but without success.

There are now two clear incentives to make it a reality. On the one hand, oil is no longer the reliable source of revenue that the state can rely on, on the other, there are measures to liberalize the economy and break the previous oligopolies. Still shy, but there are.

These two facts should make entrepreneurs feel more free and obliged to look for new areas of investment. These areas should not be civil construction, but others linked to natural resources, such as natural gas; agribusiness (Angola’s soils are some of the most fertile in Africa and its climate is manifestly conducive to agriculture. In the past, Angola was almost self-sufficient in agricultural terms, with wheat being the only exception); the forest economy (forests cover almost 18.4% of the country’s total area and form one of the country’s most critical natural resources), high-quality minerals (iron ore, manganese and tin) and solar energy, among others.

In this crisis,

Angola’s great challenge is to seize the opportunity to transform itself,

benefiting from its diversified

wealth.

[1] BNA, External Debt by countries (stock): 2012-2019. Available online at: https://www.bna.ao/Conteudos/Artigos/lista_artigos_medias.aspx?idc=15419&idsc=16458&idl=1

[2] http://www.novojornal.co.ao/politica/interior/mirex-telefona-a-homologo-chines-com-foco-na-divida-e-em-investimentos-em-angola-87980.html

[3] https://www.imf.org/en/News/Articles/2020/05/28/sp052820-opening-remarks-at-un-event-on-financing-for-development-in-the-era-of-covid-19

[4] Deeply involved in the construction of the new refinery in Cabinda, for example: https://www.africaoilandpower.com/2020/01/21/sonangol-gemcorp-sign-cabinda-partnership-deal/

[5] https://www.imf.org/en/Publications/CR/Issues/2019/12/18/Angola-Second-Review-of-the-Extended-Arrangement-Under-the-Extended-Fund-Facility-Requests-48887

[6] Cfr. Agostinho Pereira de Miranda, Setor petrolífero angolano está bem preparado para sair da crise – advogado. Available online:https://www.angonoticias.com/Artigos/item/64817/setor-petrolifero-angolano-esta-bem-preparado-para-sair-da-crise-advogado and Jaime Nogueira Pinto, Considerações sobre a crise petrolífera. Available online: https://observador.pt/opiniao/consideracoes-sobre-a-crise-petrolifera/

[7] Noah Browning et al. Angola’s oil exploration evaporates as COVID-19 overshadows historic reforms. Available online: https://www.reuters.com/article/us-global-oil-angola-insight-idUSKBN22W0OZ

[8] NASDAQ-Brent Crude (BZ: NMX). Available online at https://www.nasdaq.com/market-activity/commodities/bz%3anmx. See also https://oilprice.com/oil-price-charts/46. Note that these elements are merely informative of trends and do not necessarily reflect the exact price of Angolan oil transactions. However, they give an approximation to possible developments and perspectives.